Trident Fund LP commentary for the month ended July 31, 2020.

Q2 2020 hedge fund letters, conferences and more

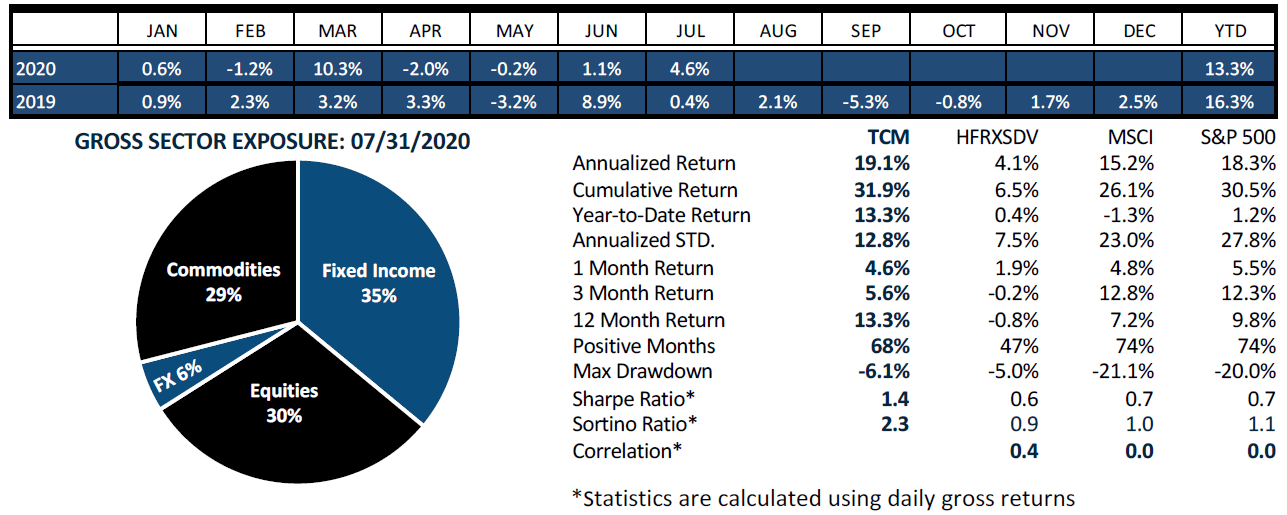

The Trident Fund LP returned +4.6 percent in July, and the fund is +13.3 percent net year to date.

Trident Fund's July Performance

The key to the strong July performance in the Trident Fund is its ability to adapt to changing market conditions and size positions according to the signals' strength. Specifically, Trident received strong signals in the Nasdaq, Gold, Brent Oil, WTI Oil, the Euro currency, and Sugar. As a result, Trident increased its allocation to those markets according to its proprietary dynamic scalar. The result was outsized profits in each of those markets, leading to Trident's second-best monthly return for the year.

Moreover, the returns were spread evenly across both of the two models traded in July, the Risk Regime model, and the Engel model. The Risk Regime model earned approximately half the monthly returns through long positions in global equity and fixed income futures markets. The Engle model made its returns from Gold, Copper, WTI Oil, Brent Oil, Gasoline, the Euro, and Sugar. Of the 19 markets that Trident trades, 15 were profitable last month.

Given the strength in the equity markets, the Vega model, which selectively "shorts" equities, did not receive a trading signal. However, the Fed affirmation of its commitment to stimulus in the face of the Corona Virus pandemic, kept the Trident portfolio in position to profit from a strong market appetite for risk.

Heading into August, the Trident portfolio continues to be in the "Risk On" position in commodities and equities. However, it is in a more defensive posture in the global fixed income markets. Trident will benefit from continued global central bank stimulus that leads to commodities inflation and dollar depreciation.

This article first appeared on ValueWalk Premium.