Stocks were little changed on Friday as investors took a breather following a wild month of trading and Trump tweeting (nowadays they seem to go hand in hand).

The equity market entered the week in an oversold condition. Eight of the eleven S&P sectors were oversold, with four of the eight coming in extremely oversold. Only Staples, Real Estate and Utilities remained in “neutral”.

Q2 hedge fund letters, conference, scoops etc

The major indexes posted their worst monthly performance since May. The Dow fell 1.7% in August while the S&P 500 lost 1.8%. The Nasdaq pulled back 2.6%. U.S.-China trade relations intensified this month, rattling investors.

The Cboe Volatility Index (VIX), widely considered to be the best fear gauge on Wall Street, traded as high as 24.81 in August before pulling back to around 18. Investors also loaded up on traditionally safer assets such as gold and silver this month. The SPDR Gold Trust (GLD) rose 8% in August while the iShares Silver Trust (SLV) surged 12.8%.

Choppy intraday market action continued during the month as traders stayed fixated on the 2/10 Treasury spread and the Trade/Tweet situation.

Last week, China retaliated against U.S. tariffs by unveiling levies of its own that target $75 billion in U.S. products. President Donald Trump then said the U.S. would hike tariffs on a slew of Chinese products.

Our Take

In our view, despite signs of global economic weakness markets want to go higher. Nevertheless, without proof of actual movement towards a trade ‘truce, in addition to a cooling of Trump rhetoric lambasting the Fed, American Business as well as China, the probability of a self inflicted recession is growing.

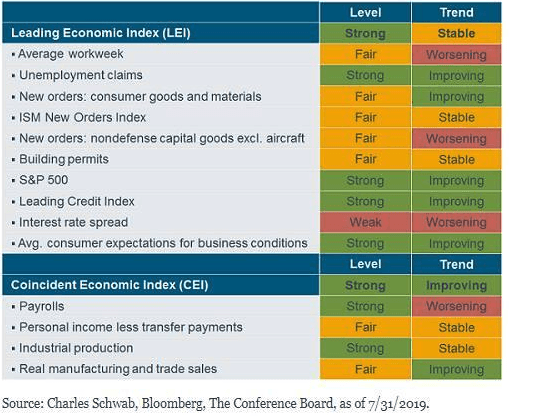

Charles Schwab sees leading indicators flashing limited recession warning:

Although the levels of the leading and coincident indicators remain mostly green (strong) and yellow (fair); there has been a pickup in the number of red (worsening) trend readings; albeit having improved from the prior month in the case of the LEI.

Although the tariffs in place remain a drop in the bucket of this 20 Trillion dollar Amercican economy, the onset of a downturn is as much a matter of mood as of money. Although recessions can be linked to the after effects of shocks, they can also be linked to periods of time when people and firms fail to use valuable resources as they become available. In these garden variety slumps, people and firms with the capacity to spend more, who might normally leap at the chance to buy discounted goods or hire overqualified workers, instead allow their cash to pile up. Sound familiar?

In a recent Economist article, we are reminded that at the heart of this behaviour is a matter of mass psychology, or “animal spirits”, as John Maynard Keynes put it. “Economies are great chains of earning and spending, held together by shared expectations that all will continue as normal. People spend incomes freely, on everything from homes to haircuts, in the belief that their jobs will not disappear and their incomes wither. Faith in economic expansion is self-fulfilling. But it is not invulnerable. Contagious pessimism can flip an economy from one equilibrium to another, in which cautious consumers spend less and hiring and investment fall accordingly. If the mood in markets and on Main Street is sour enough, even a modest nudge may push an economy into a slump.” Is Trump’s frantic leadership style helping or hindering this “faith in economic expansion”?

Instead, we are witnessing an erosion of such faith as each time consumers or market participants attempt to be optimistic about the outlook for the U.S. economy, they are punched in the gut by a Trump tweet.

Considering the big picture, it is conceivable that China just might be able to doom Trump’s reelection chances—just as Russia helped put him in office in the first place by interfering in the 2016 presidential election in what the Mueller Report called “sweeping and systematic fashion.”

As recently reported in Bloomberg: “China is suffering more from the trade war than the U.S. is, as Trump has accurately observed. The difference is that Chinese President Xi Jinping does not have to worry about an upcoming election. His new strategy seems to be to outlast Trump and hope that the next occupant of the White House will be more reasonable.”

As the U.S. economy is beginning to show signs of weakness, Trump has reason to fret. He has built his argument for reelection on American prosperity. His hopes for winning the race may hinge in no small part on stopping the U.S. from tumbling into a recession before November 2020.

Only two presidents since World War II — Democrats Harry Truman and Jimmy Carter — have run for reelection in the same year as a recession. While Truman won and Carter lost, history suggests an economic slump would damage Trump’s chances in what will already be a tough 2020 race.

Metrics such as the University of Michigan Consumer Sentiment Index help track consumers views’ on and expectations for the economy. The metric typically plummets during recessions. Over the survey’s history back to the mid-20th century, it has “largely” found that “if the index is low, the incumbent doesn’t get reelected,” said Richard Curtin, director of surveys of consumers at the University of Michigan.

What have you done for me lately?

The longer this trade war drags on the answer for Trump is increasingly trending towards a big: “nothing”...

Musings

In a recent article Michael Batnick reminds us that investors are always told to think long-term, but how are we supposed to do this in a world that gives presidential candidates 30 seconds to make a point?

This point rings more true today than at any other point in my investing career. Multiple daily market moving headlines is the new norm. One worries about how the day will end let alone the month, quarter or decade.

During a recent conversation with a potential investor I was asked how we at Logos LP handle this seemingly minute by minute investing climate.

The way we approach this question is through the lens of Pascal’s suggestion that “All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” It is in our human nature to want to tinker. Dissatisfaction and unease are inherent parts of human nature as this kind of suffering is biologically useful.

It is nature’s preferred agent for inspiring change. We have evolved to always live with a certain degree of dissatisfaction and insecurity, because it’s the mildly dissatisfied and insecure creature that’s going to do the most work to innovate and survive. As Mark Manson writes in his book: “This constant dissatisfaction has kept our species fighting and striving, building and conquering. So no- our own pain and misery aren’t a bug of human evolution; they are a feature.”

Thus, our own human nature can stand in the way of superior investment results ie. thinking long term, tuning out the noise and staying the course.

If you are willing to accept and maintain a certain faith in long-term sustained economic expansion, thinking long-term when it comes to investing simply means that you maintain an acute awareness of your “human” penchant for dissatisfaction and unease. That you recognize your desire to tinker and don’t act on it. You don’t act out of emotion. You stick to the plan despite your troubles and your insecurities.

As Aristotle once said: “Knowing yourself is the beginning of all wisdom.”

Charts of the Month

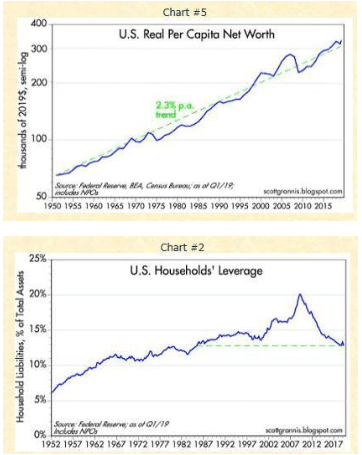

Net worth is at an all-time high, while leverage is down to levels seen in the 1980's. All of this evidence supports the notion that the consumer is well positioned to keep the economy on level footing.

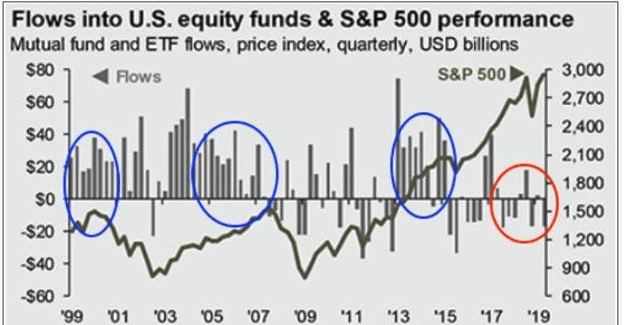

Chart Courtesy of Urban Carmel, Data Source; J.P. Morgan.

J.P.Morgan notes;

Fund flows into equity mutual funds and ETFs was strong before both the 2000-02 and 2007-09 bear markets, and even before the 2015-16 mini-bear market (blue circles). In comparison, fund flows have been negative for 5 of the past 8 quarters (red circle)

Logos LP July 2019 Performance

July 2019 Return: 4.45%

2019 YTD (July) Return: 30.93%

Trailing Twelve Month Return: 8.33%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: +16.02%

Thought of the Month

"Everyone thinks of changing the world, but no one thinks of changing himself.” -Leo Tolstoy

Articles and Ideas of Interest

- The next recession will destroy millennials. My generation just can’t catch a break. The trade war is dragging on. The yield curve is inverting. Investors are fleeing to safety. Global growth is slowing. The stock market is dipping. Millennials are already in debt and without savings. After the next downturn, they’ll be in even bigger trouble. In addition low interest rates benefit pensioners not millennials…

- Is our economy in The Upside Down? Something is strange with the economy. Normally, in good times, the government seeks to balance its books a bit, borrowing less, paying off some debt or — gasp — maybe even aiming for a budget surplus. And right now, on some important measures, economic times are good. But the government has been increasing spending and cutting taxes — and the budget deficit is projected to grow to nearly $1 trillion, an increase of over 35% since the Tax Cuts and Jobs Act was passed in 2017. Meanwhile, the Federal Reserve would normally be raising interest rates to make sure the price of everything doesn't get out of control. But high inflation is nowhere to be seen, and the Fed is now cutting interest rates. We're living in the Upside Down. It's an alternate dimension where economic textbooks are being thrown out the window. A scary place where despite big deficits and easy money, the economy is slowing down to a rate below historical averages and wage growth remains disappointing. And it's a place where frightening monsters, or demogorgons, continue to scare away investment and productivity while kids now dream of being YouTubers rather than astronauts.... Slaying these monsters is the key to growth and prosperity, but we seem to be stuck in this new world where investment and productivity will not come roaring back. Can we escape?

- The non-weirdness of negative interest rates. Savers in Europe are having to pay to store their wealth. That’s not so crazy when saving is all too plentiful. We are now at $17 trillion in negative yields globally in addition to certain european banks who are now paying customers to take out mortgages by offering negative interest rates. Banks paying people to borrow money is a bad sign for the global economy as it suggests that a fast-rising share of investors are so nervous about the future they’re willing to actually lose a little money by lending it to a borrower that is almost certain to pay it back, rather than risk betting on something that could go bust. In a healthy economy, investors would put their money to work in profit-making ventures such as factories or office buildings. There’s an obvious, persistent and continuous glut of underutilized capital and there’s no place in the advanced world for that capital to be invested without excess risk. The problem is that such negative rates don’t seem to be having the desired effect of stimulating the creation of profit making ventures and therefore growth. Research shows that negative rates actually CUT lending as they don’t create the right incentives to spend and invest.

- We’ve reached peak wellness. Most of it is nonsense. In Silicon Valley, techies are swooning over tarot-card readers. In New York, you can hook up to a “detox” IV at a lounge. In the Midwest, the Neurocore Brain Performance Center markets brain training for everything from ADHD, anxiety, and depression to migraines, stress, autism-spectrum disorder, athletic performance, memory, and cognition. And online, companies like Goop promote “8 Crystals For Better Energy” and a detox-delivery meal kit, complete with “nutritional supplements, probiotics, detox and beauty tinctures, and beauty and detox teas.” Across the country, everyone is looking for a cure for what ails them, which has led to a booming billion-dollar industry—what some have come to call the Wellness Industrial Complex. The problem is that so much of what’s sold in the name of modern-day wellness has little to no evidence of working.

- It has gotten too hard to strike it rich in America. Many of the traditional ways of accumulating wealth are out of reach. In a free-market economy everyone is supposed to have the chance to get rich. The dream of making it big motivates people to take risks, start businesses, stay in school and work hard. Unfortunately, in the U.S., that dream seems to be dying. There are still plenty of rich people in the U.S., and their wealth is increasing. But people outside that top echelon are having a tougher time breaking in. A 2017 study by the Federal Reserve Bank of Cleveland found that the probability that a household outside the top 10% made it into the highest tier within 10 years was twice as high during 1984-1994 as it was during 2003-2013.

- Want to beat venture capitalists’ returns? Invest in publicly listed innovators through the NASDAQ. Everyone has heard that story about an angel or vc fund that invested in a start-up company at seed or early stage and reaped 100-1000 times returns. Investors hear about such stories and, wanting to reap the same returns for themselves, start exploring angel and venture capital investments. The above instances are exceptions, but given the extraordinary returns generated, they get talked about. However, for every such exceptional investment, there are at least a 100 or possibly 1000 investments where the capital is completely destroyed. Once you account for those, what are the returns to Venture Capitalists? According to a study by Cambridge Associates, the US Venture Capital investors got compounded annual returns of 12.83 per cent (net) over the 10 years from 2008 to 2018, in USD terms. Now, that is not something small. However, over the same period the Nasdaq composite returned 15.45 per cent annually with full liquidity...Headlines sell, facts deliver.

- Evidence shows you’re not open-minded. Do you think of yourself as open-minded? For a 2017 study, scientists asked 2,400 well-educated adults to consider arguments on politically controversial issues — same-sex marriage, gun control, marijuana legalization — that ran counter to their beliefs. Both liberals and conservatives, they found, were similarly adamant about avoiding contrary opinions. The lesson is clear enough: Most of us are probably not as open-minded as we think. That is unfortunate and something we can change. A hallmark of teams that make good predictions about the world around them is something psychologists call “active open mindedness.” People who exhibit this trait do something, alone or together, as a matter of routine that rarely occurs to most of us: They imagine their own views as hypotheses in need of testing.

Missed a Post? Here's the Last 5:

- The Disciplined Pursuit of Less

- These Halcyon Days

- Stocks Have Become Cheaper Than 4 Years Ago

- Get Out or Go All In?

- Can God Beat Dollar Cost Averaging?