The trade war between the U.S. and China has been taking a toll on the market. However, trade finance hedge funds have held up pretty well despite the challenges. The Eurekahedge Trade Finance Hedge Fund Index is up 2.78% for 2019 through the end of June.

Trade finance hedge funds are trailing fixed income funds as yields have been declining. However, last year these hedge funds gained 4.73%. significantly beating their benchmarks and the overall global hedge fund industry. The Bloomberg Barclays Global-Aggregate TR Index and the Merrill Lynch US High Yield Master II Index were both in the red for 2018, while the Eurekahedge Fixed Income Hedge Fund Index was up a mere 0.04% for the year.

Q2 hedge fund letters, conference, scoops etc

Demand for alternative assets grows

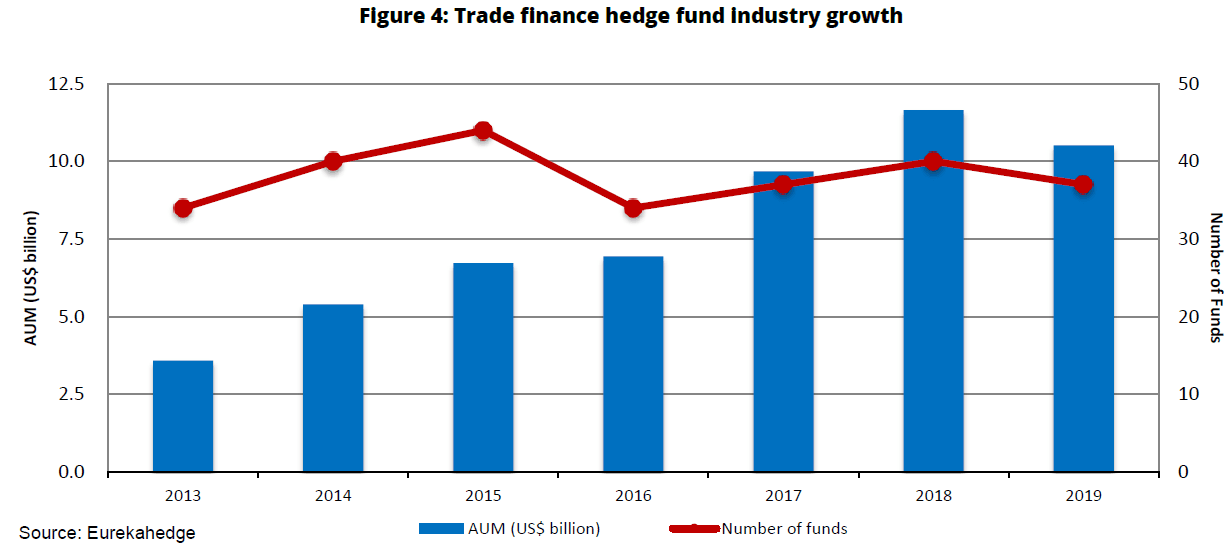

According to Eurekahedge, investor demand for alternative assets with consistent returns and low volatility has driven growth in trade finance hedge funds. The steady growth of this niche began after the 2008 global financial crisis. At that time, banks were slashing their exposure to this category so they could comply with the Basel III capital requirements. Eurekahedge launched its Trade Finance Hedge Fund Index last year to track this niche. The index is made up of 15 actively managed funds focusing on this sector.

Because of the low volatility observed in trade finance strategies, these fund managers have generated excellent Sharpe ratios in recent years. According to Eurekahedge, these hedge funds have been outperforming their benchmarks in Sharpe ratios by a wide margin. Over the last five years, trade finance funds have generated a Sharpe ratio of 5.6.

The strategy has also provided downside protection for investors. The maximum drawdown of the strategy has been a mere 0.02% over the last give years. Meanwhile, the Bloomberg Barclays Global-Aggregate TR Index saw a maximum drawdown of 7.66%, while the other two benchmarks saw drawdowns in the double digits.

Trade Finance Hedge Fund Returns Are Impressive

The Eurekahedge Trade Finance Hedge Fund Index has also managed positive alpha against their benchmarks. Between the end of 2009 and June 2019, these hedge funds yield 0.52% alpha against the global investment grade bond index and 0.5% alpha against the high-yield bond index.

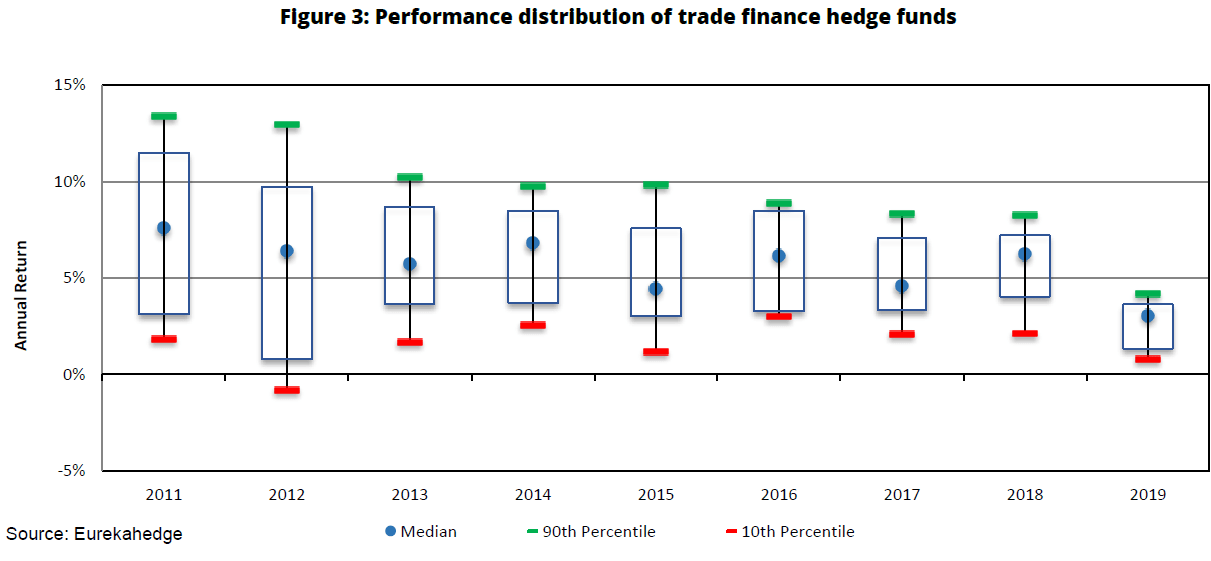

Eurekahedge also said 2012 was the only year since 2011 that more than 10% of the funds in its Trade Finance Hedge Fund Index posted losses.

The publication expects more capital to flow into the trade finance niche because of the consistent returns and low volatility. However, there are some problems with investing in this niche, like how difficult it is to perform due diligence on the asset class. These types of hedge funds tend to lack transparency and standardization. Thus, their operational costs have been high, and they may start charging higher fees as a result. The average fees among the trade finance hedge funds tracked by Eurekahedge are 1.56% for management fees and 16.63% for performance fees. Both of these numbers are fairly high compared to the fees of recently launched funds in all strategies.

This article first appeared on ValueWalk Premium