Debt can weigh heavy on our hearts and minds, to the point of affecting the overall quality of our lives. Just about 80% of adult Americans are currently in debt – from student loans to credit cards and everything in between – and medical debt is the leading cause of personal bankruptcy nationwide.

Given the sheer number of people that are burdened with debt and loans in the United States, The Ascent by The Motley Fool set out to dig a little deeper into the link between life satisfaction and being on the hook financially by surveying 1,000 indebted Americans. The first thing they discovered was a fairly middling perception regarding money’s ability to buy happiness: just over half of their respondents said they thought it could “to an extent.”

[REITs]Q1 hedge fund letters, conference, scoops etc

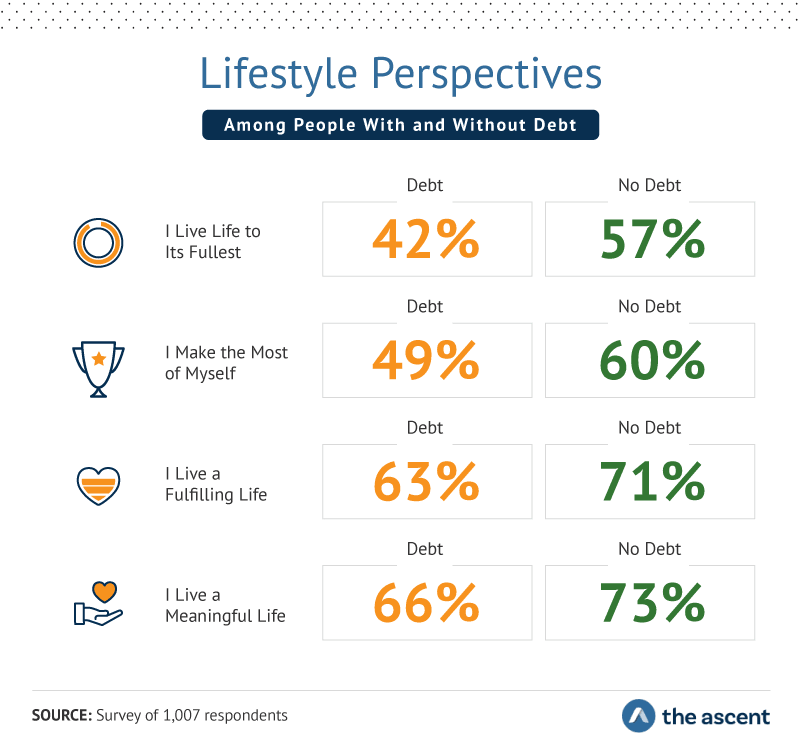

No matter their level of indebtedness, a majority said they were generally happy with their lives, though having outstanding loans was indeed a detractor overall (70% of people with debt, 83% without). The least satisfied group was populated by people with medical debt, but even then, 64% still had a sunny outlook on their lives. People with mortgages expressed the highest satisfaction level of the bunch, at 86%.

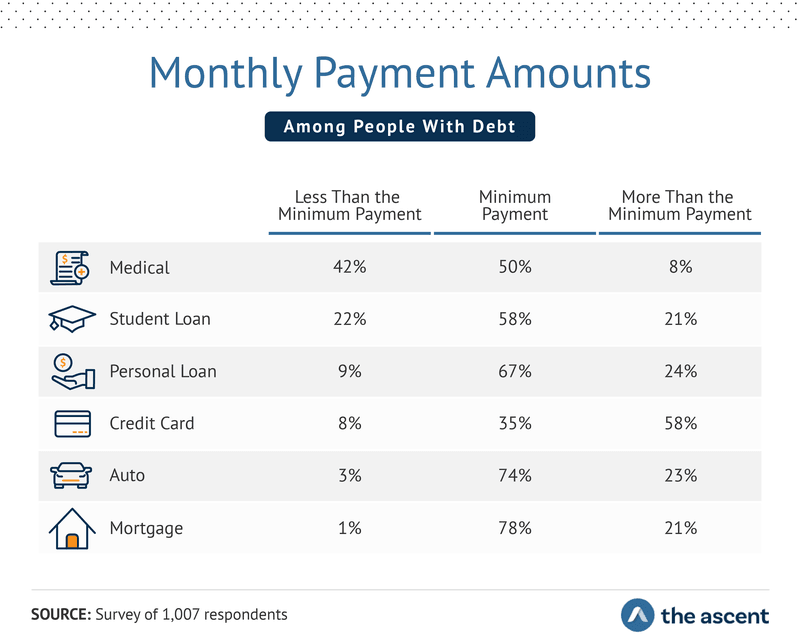

In general, the respondents reported fairly impressive rates of making their minimum payments each month, if not exceeding them. Medical debt and student loans were the only notable exceptions, with 42% and 22% saying they were unable to dole out their monthly minimums, respectively.

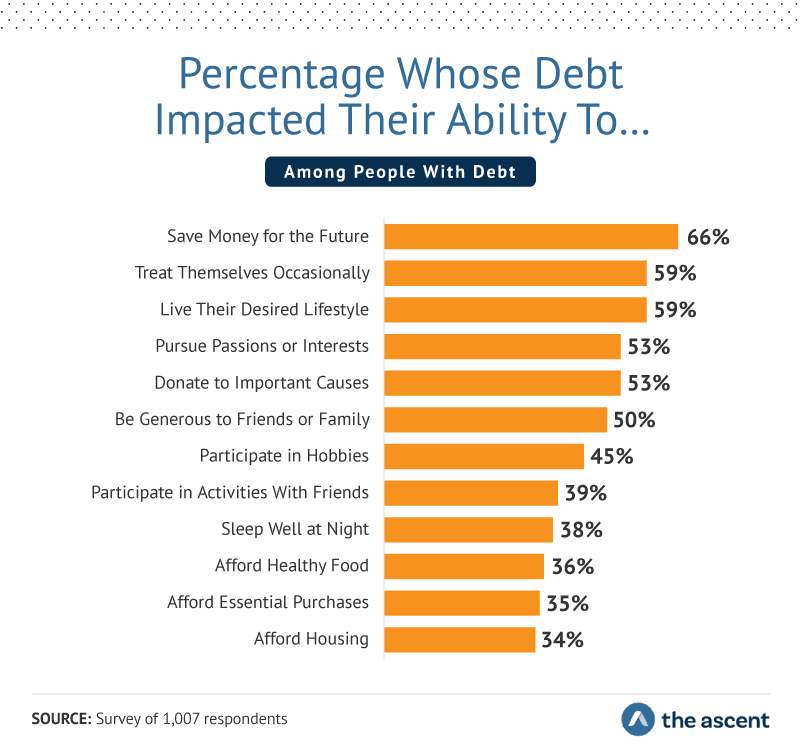

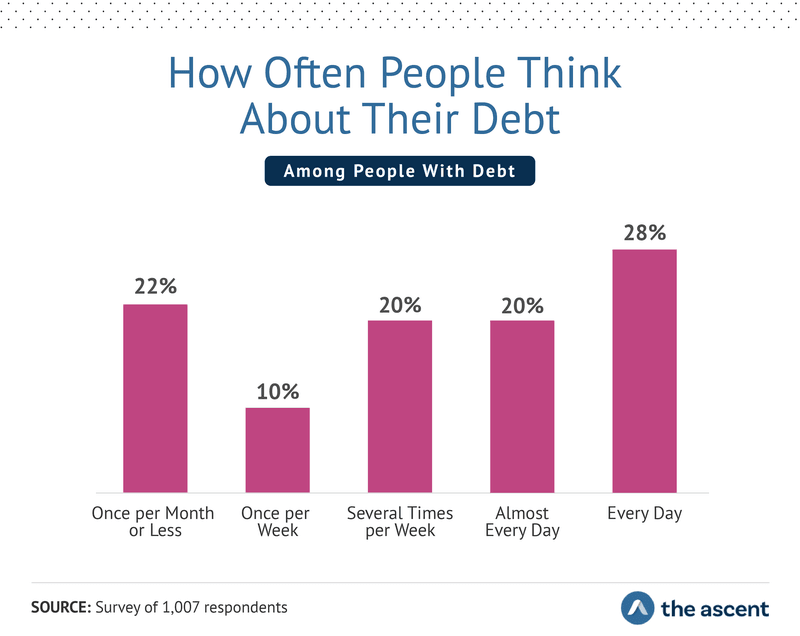

Among people with debt, nearly half said that this part of their lives affected their optimism, self-esteem, and sense of direction: the majority were unable to do life-affirming things like save for the future, treat themselves occasionally, live the lifestyle they wanted, or pursue their passions. Nearly three-quarters found themselves ruminating about their debt more often than they’d like.

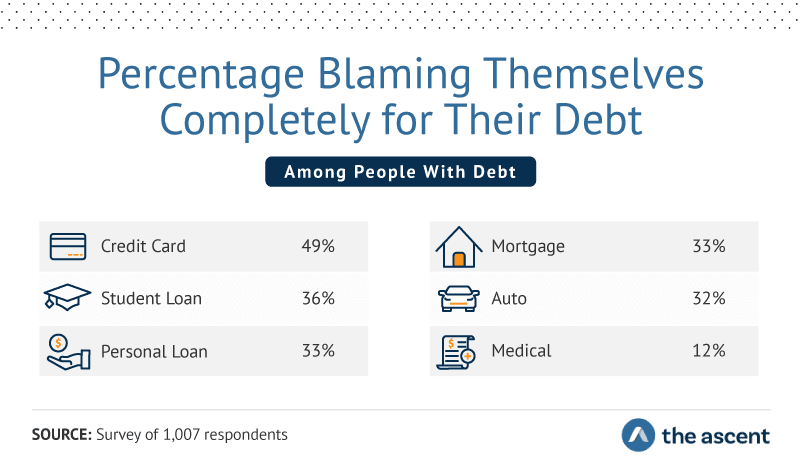

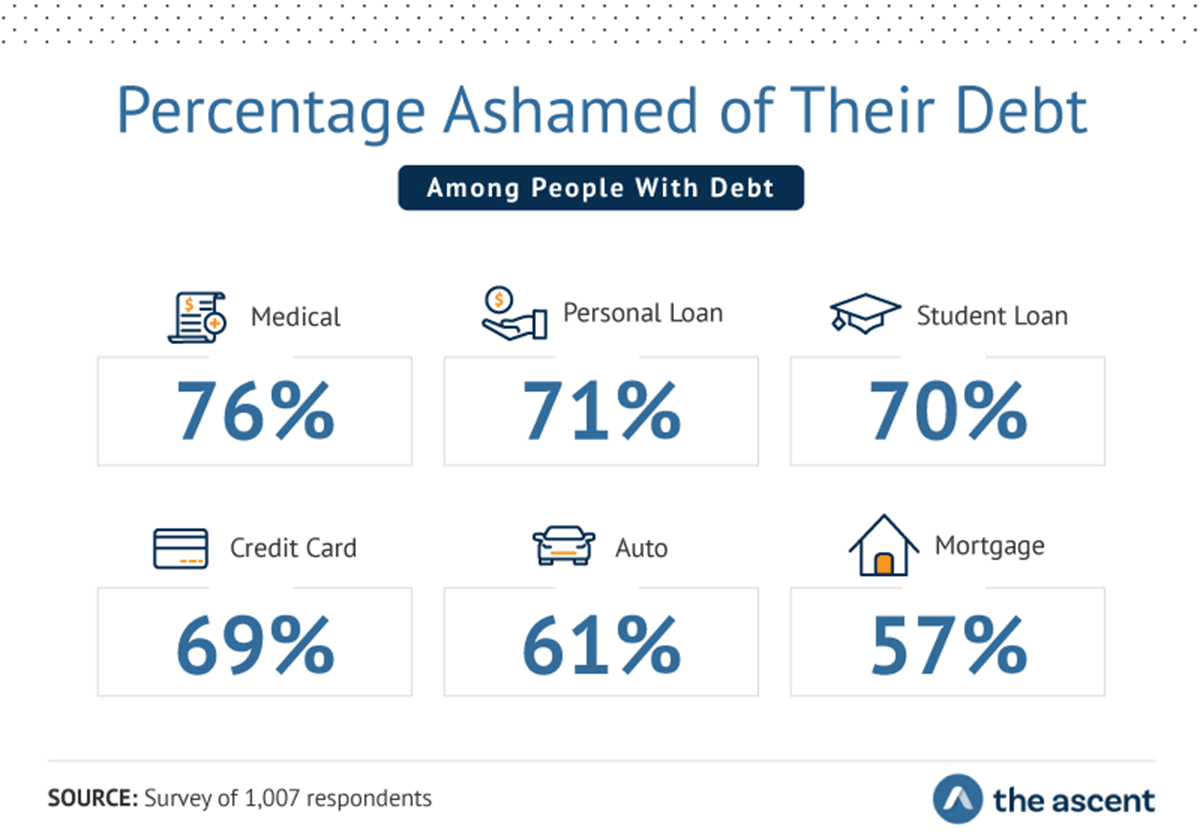

Feelings of blame and shame were also prominent among this group of people: 49% blamed themselves for their credit card debt, and 36% of people with student loans did the same. When it came to shame, the numbers were even worse: 76% were embarrassed about their medical debt, while 71% felt badly about a personal loan. Even mortgages, which are considered by many to be “good debt,” left 57% of people feeling bad about their decisions.

Get a Personal Loan up to $100,000. See Multiple Quotes in Minutes!

Given the sheer number of Americans living with debt and the amount of heartache they experience every day as a result, the time is now to end the stigma, the blame, and the shame. Setting realistic goals in order to get out of debt is the first step towards financial unburdening, coupled with patience and being kind to yourself on more emotionally difficult days.

You can view the full study here.