An update from Crescat Capital shows they had a fantastic October, but many hedge fund return stats were less impressive.

Third Point’s Dan Loeb which has been dueling with Cambell Soup had a rough month down 6.7 percent or so.

Bill Ackman’s Pershing Square Capital which had been mounting a comeback year, put up awful number of -8.4 percent.

Bearish hedge fund JHL Capital which is a personal holding of Seth Klarman’s foundation had a rough month. The fund was down 3.7 percent according to an investor update seen by ValueWalk, wiping out year to date gains.

Stanphyl Capital had a rough month – their October letter to clients states the following regarding hedge fund return numbers:

For October 2018 the fund was down approximately 7.0% net of all fees and expenses. By way of comparison, the S&P 500 was down approximately 6.8% while the Russell 2000 was down approximately 10.9%. Year-to-date the fund is down approximately 15.5% while the S&P 500 is up approximately 3.0% and the Russell 2000 is down approximately 0.6%.

Since inception on June 1, 2011 the hedge fund fund return is approximately 68.8% net while the S&P 500 is up approximately 135.5% and the Russell 2000 is up approximately 97.3%. Since inception the fund has compounded at approximately 7.3% net annually vs 12.2% for the S&P 500 and 9.6% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends.)

If you’ve been reading my letters, you’re undoubtedly thinking “Hey, this guy’s been bearish all year and this month he was finally right in a big way yet he still lost money. What the heck is going on?” The short answer is: all our bearish bets worked except one, and that one was Tesla which soared on a completely unsustainable earnings report.

On the other hand, Alpha Wealth Funds does nto have full numbers yet, but their Theta Fund had positive returns in October, according to an email to investors.

Also on the positive end, Greenlight Capital had a good October.

Einhorn with a good month finally https://t.co/8eJ2Fe9Aud pic.twitter.com/6crTwfCWwY

— ValueWalk (@valuewalk) October 31, 2018

Stay tuned for more numbers as we get them. Below is Crescat’s investor update on their October:

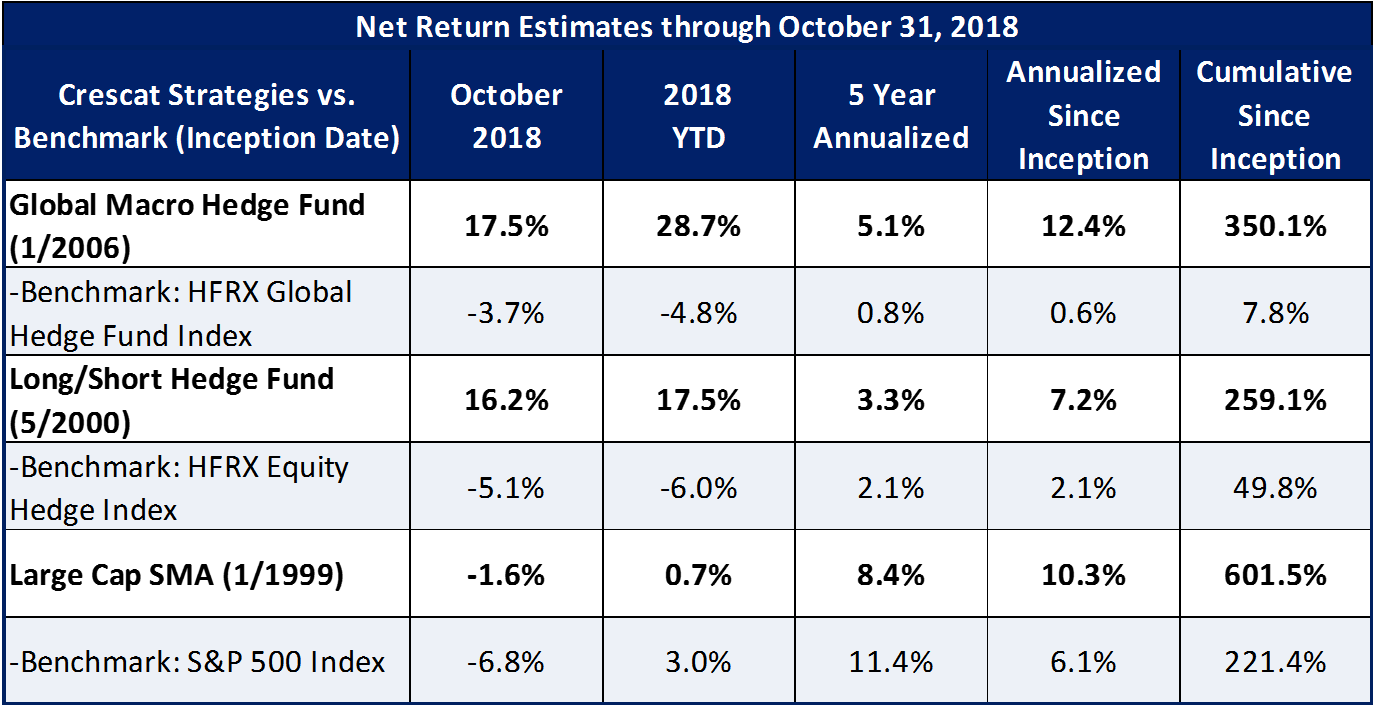

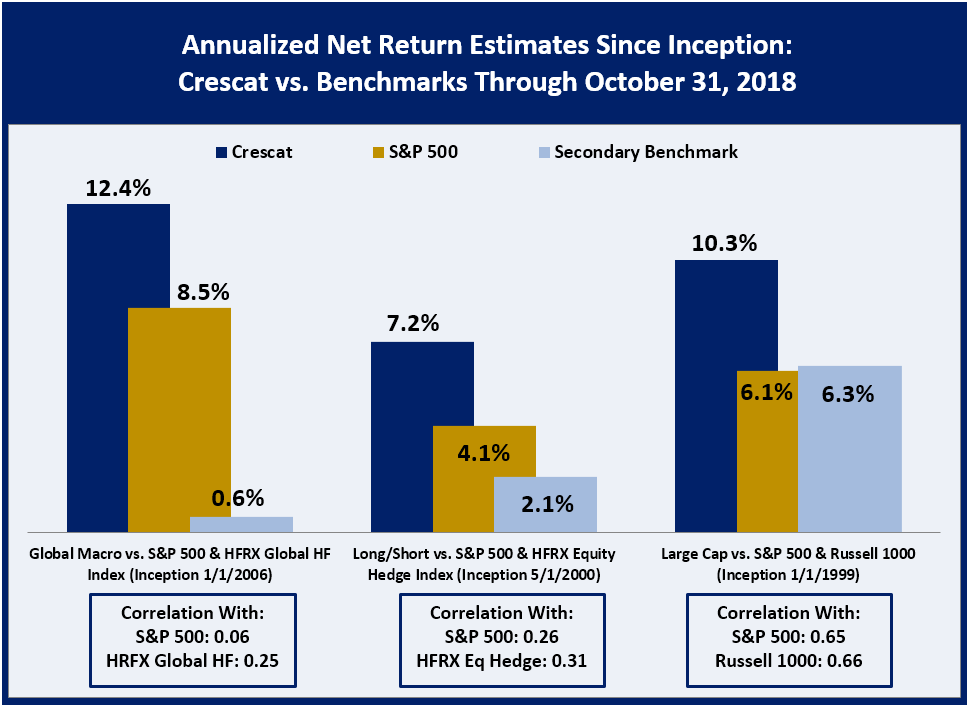

With the close of month, we are happy to share October estimated performance results for Crescat Capital. Our flagship Crescat Global Macro fund returned an estimated 17.5% during the month of October and now sits at an estimated 28.7% YTD. Compared to 3% YTD for the S&P 500.