Jeffrey Gundlach’s presentation from the 2018 Sohn Conference. The bond guru gave a surprising equity short idea – Facebook Inc. (NASDAQ:FB) being the target see below for more on that

Jeffrey Gundlach is CEO of DoubleLine. In 2011, he appeared on the cover of Barron’s as “The New Bond King.” In 2013, Institutional Investor named him “Money Manager of the Year.” In 2012, 2015 and 2016, he was named one of “The Fifty Most Influential” in Bloomberg Markets. In 2017, he was inducted into the FIASI Fixed Income Hall of Fame. Mr. Gundlach is a summa cum laude graduate of Dartmouth College, with degrees in Mathematics and Philosophy.

Q1 hedge fund letters, conference, scoops etc

Jeffrey Gundlach 2018 Sohn Conference Comments

'We all know the definition of a long-term investor? A long-term investor is a trader who is under water" inflation is risding across the board says Gundlach remains bullish on commodities and oil

Jeff Gundlach notes that only about 12 percent of US citizens wereb in favor of "helicopter money" in 2016 but nearly half liked the idea of Universal Basic Income

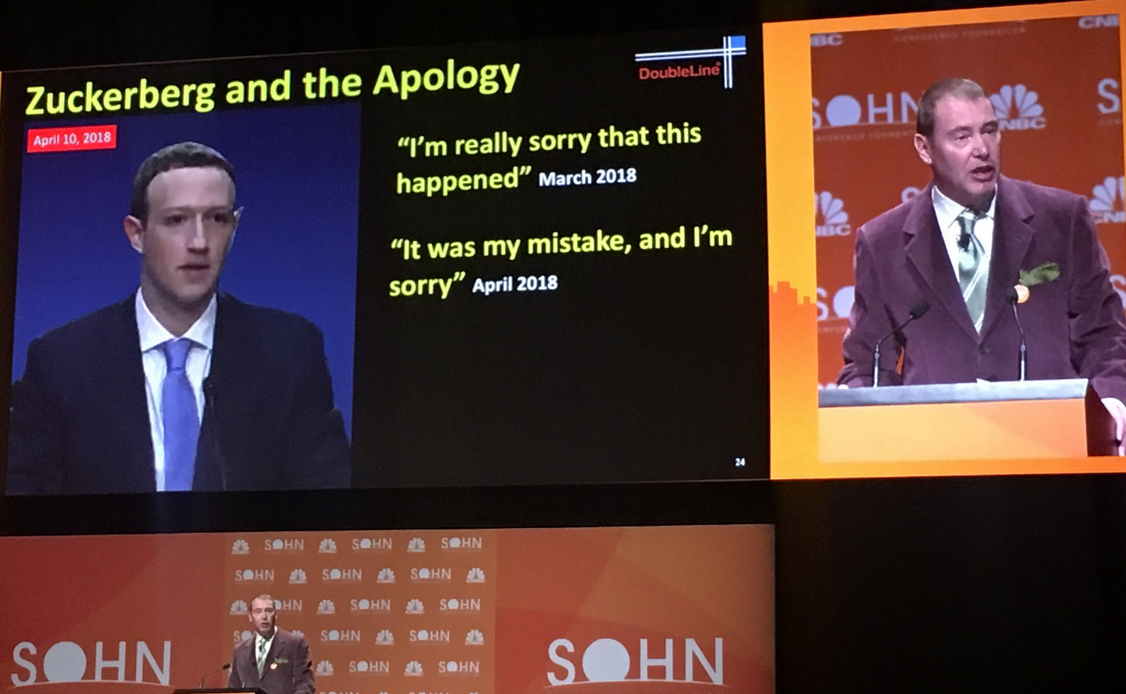

Gundlach calls Zuckerberg a phony - yes that one Mark the CEO of Facebook Inc. (NASDAQ:FB) and here is the slide to prove it

Once again Gundlach is all over the place what will he pitch this year?

- And here it is Gundlach says he is short Facebook shares and long S&P oil and gas, short XOP

- Gundlach opines that 2.2B Faceook users represent 2.2B compliance breaches which could be a massive fine.

- He also thinks that FB chart looks ugly (I guess technicals he may have mentioned 200 and 50 day moving average but I am not sure check back on that)

- Since Gundlach was on tanget he did not spend much time on FB short but this is it in summary

- Social media good vs i-spy media bad, bullying media

- Regulation prices out competition good, vs monopoly bad

- Facebook with 200 day moving average 1 year

- Look for signs, large amount shares traded

- Investment recommendation long xop and short facebook

More from Jeff Gundlach on Facebook, Commodites and more from his CNBC interview today

Gundlach: There aren't any recession signs right now from CNBC.