The Australian conglomerate Wesfarmers is demerging its largest company within its portfolio, and from the day it was purchased it has been an example of the axiom; the price you pay for an asset determines your investment return. Which is what Warren Buffett refers to when he says’ “Price is what you pay and value is what you get.”

Heads up, the 10-Week Investment Analysis Program enrolment ends this Saturday at midnight, and places are limited to 25 investors, so hurry and secure your place now, click here. But only apply if you are committed to mastering the investment game. click here.

Summary:

- Australian conglomerate Wesfarmers demergers it’s largest holding company Coles.

- 10 years after Wesfarmers purchased the Coles Group for AUD$19 billion it is only estimated to be worth $19 billion by Credit Suisse.

- How Wesfarmers is masking the real EBIT earnings of Coles in their annual reports and it is looks like a coming train wreak.

Wesfarmers’ chief executive Rob Scott announced a demerger of Coles from Wesfarmers’ by spinning off Coles as a listed ASX independent company.

“Therefore a demerger is a logical way of separating the businesses and giving our shareholders the opportunity to have a direct interest in Coles.” CEO Rob Scott

Wesfarmers’ will retain 20% ownership of the newly listed entity and the remaining 80% ownership will be transferred to current Wesfarmers shareholders’ via newly issued shares.

The Australian Financial Review reported that Mr. Scott said every business in Wesfarmers’ was theoretically for sale, but a demerger was the best way of separating Coles from the Wesfarmers’ business without incurring capital gains tax.

So, you will have the opportunity to buy an ownership share in Coles in the near future (6-8 months according to Mr. Scot), if you aren’t already a Wesfarmers’ shareholder, but should you?

It was reported in the Financial Review that Credit Suisse put the value of Coles at $19 billion (All amounts in Australian dollars & Source).

Amusingly, that was the same price they paid for Coles in late 2007.

The most optimistic valuation I calculated for Coles was $13 billion, but once the optimistic assumptions are removed from the equation the valuation drops like a stone.

I’m not surprised by Credit Suisse’s excessive valuation, if I wanted to handle the demerger of a company the size of Coles and earn large handsome profits, I too would butter up Wesfarmers’ Management by publicly announcing an excessively high valuation for Coles.

But, what value is Coles’ worth?

Wesfarmers’ reports Coles’ income on an EBIT basis, but it does something else you should know about.

It adjusted reported capital expenditure spent each year using accrual account practices.

For instance, in 2017, $811 million was the reported amount of capital expenditure spent, but that number was reduced due to movement in accruals, once the accruals were added back the amount rose significantly to $1.68 billion.As no more detail was provided in the annual report, we will update this preliminary report when new data is released. So, we have to adjust the reported capital expenditure for all 6 years.

Adding back the accruals is necessary as it isn’t necessarily a cash payment, and it would not appear in the cash flow statement, but the capital expenditures – stated as Plant, Property & Equipment – would appear as a line item under Cash Flow Investing Activities.

Not surprisingly, once adding back the accruals, Coles’ capital expenditures bring it back in-line with its nearest competitor capital expenditures – Woolworths.

Once the readjustment was made for the last 6 years, it resulted in the 6-year average EBIT figure of -$803 million. All previous 6 years EBIT figures were negative.

Coles’ supermarkets before Wesfarmers purchased them in late 2007 were severely lacking in investment, the majority of stores were in bad shape. So it was expected that large capital expenditures were needed to be invested by Wesfamers’ to get Coles’ supermarkets up to standard to just compete with Woolworths.

Before we go any further consider that in late 2007, Wesfarmers paid $19.4 billion for the Coles Group.

What did it get for the $19.4 billion? Let’s do some back of the envelope calculations.

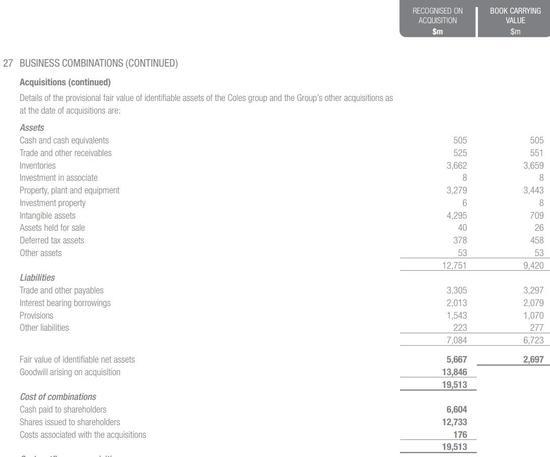

Wesfarmers 2007 Annual Report - Apologize for low pic quality.

This is a snapshot of the asset and liability values of the Coles Group when Wesfamers purchased it. (Note 27, 2008, Wesfarmers Annual Report).

The carrying book value stated above is $2.6 billion. Using enterprise value (EV) method (assets + liabilities: modified EV version), the Coles Group was worth $16 billion.

Reproduction Value (RV) method is similar to book value but revalues the assets to reflect their current economic value, and is reflected above in Note 27, under the column Recognised on Acquisition, which is the figure we’ll use ≈ $5.8 billion.

Let’s compare the return on valuation method ratio for all three valuation methods.

Reported net profit for was $748m in 2007 (a 32% drop in net profit from previous year) – (Source Coles Group annual report 07).

- BV return is 29%

- EV return is 4.70%

- RV return is 3.90%

- Actual purchase price return on 19.4 billion is 4%. (Percentages rounded)

Before a cent was invested in the Coles Group to restructure and refurbish it, Wesfamers was only earning a 3.90% return on its initial investment.

Let’s now compare Coles’ valuation after 10 years, using Wesfarmers reported numbers in their 2017 annual report.

BV = $16.7 billion

EV = $35.4 billion

RV ≈ $18 billion

Reported Net Segment Income BT $1,609 million.

BV return is (1609 / 2007 BV) = 62%

EV return is (1609 / 2007 EV) = 10%

RV return is (1609 / 2007 RV) = 28%

Original purchase price return is (1609/19400) = 8.20%

So, without a single cent of external investment, after 10 years, the return increased by 4%.

Quite a dismal return on $19 billion considering inflation average 3%, and that’s without adding in the capital expenditure spent on restructuring and refurbishment of all supermarkets owned by Coles.

In the part 2, I’ll reveal the secret to calculating the capital expenditure maintenance calculation that Buffett himself refers to in his annual reports, which he calls “owner-earnings”, as applied the to above Coles capital expenditures.

Thanks for reading.

– Adam

P.S. Don’t rely on reading a financial commentators latest “hack” or tactic used incorrectly – I want you to beat them at their own game. I will coach you step for step through the investment valuation process. A valuation process proven for over 60 years – Click Here.

Article by Searching For Value