There’s a saying that goes “Those who predict don’t know, and those who know don’t predict”. Even now, we still live in an age where sell-side analysts remain a prominent and influential part of the investment universe.

With all of that said, can we rightly criticize sell-side analysts for misinterpreting past results and steering less sophisticated potential investors into investment choices with inferior risk/return characteristics?

To that bolded question, I unequivocally say “yes”. Like anyone else, it’s much easier to write about and analyze what you know well. As my day job is running a bond portfolio I am an astute follower of well known bond fund managers such as Jeffrey Gundlach, Lacy Hunt, and Bill Gross among others.

An interesting article caught my eye this week as Morningstar released their list of candidates for “Bond Fund of the Year”. As a shareholder of the DoubleLine Total Return Fund since inception, I found comments made very peculiar. Eric Jacobson of Morningstar wrote the following on December 12, 2011:

“There were some standouts (in the intermediate-term bond group), such as Jeffrey Gundlach, the manager of DoubleLine Total Return Bond (DBLTX), which smoked its competitors with a 9% gain through Dec. 6. But while that fund and Gundlach clearly deserve an honorable mention, the fund’s fat returns were fueled by atypically large stakes in nonagency and exotic mortgage-backed securities. Those allocations gave it a much more aggressive risk profile than that of most rivals and could make the fund perform quite differently than most investors would expect from a more conventional core bond offering.”

Regular readers of my blog and anyone within shouting distance of the fixed-income markets knows that this bolded statement is flatly false. In fact, non-agency MBS has been one of the poorest performing sectors within the bond markets as the risk-off trade has hit RMBS hard. The below shows the ABX index thus far in 2011. While this is a synthetic index that’s used to track subprime (DoubleLine mainly owns Alt-A & Prime), it is nonetheless a decent proxy for the average reader to see how far its fallen.

Now that we have that cleared up, where has his outperformance come from? Earlier this year many bond fund managers were bracing for higher rates and holding many defensive short bonds. A review of DoubleLine’s holdings shows many prudent purchases such as Ginnie Mae last cash flow (LCF) CMO’s bought at a deep discount. A number of these bonds which were purchased in the $70’s are now trading well north of par. Even more prescient was purchasing these Agency CMO’s with Jumbo mortgage collateral. This type of collateral pre-payed quickly – a benefit when you are purchasing bonds at a discount to par.

As we are speaking about CMO’s such as this, it brings up another gross misrepresentation by Morningstar. Morningstar employee Karen Dolan, CFA, wrote on November 11, 2011:

“If a fund’s process or risk profile changes, it can affect its rating. For example, DoubleLine Total Return Bond (DBLTX), managed by Jeffrey Gundlach, has really sparkled since it launched in 2010. The fund has posted outstanding returns, paid one of the highest yields in its peer group, and has been resilient when markets turned choppy. Yet, Gundlach is employing his heretofore successful process differently today than when he was at TCW; the portfolio is steeped in esoteric securities that have histories of suffering in market panics regardless of their fundamentals. Stated more simply, though the fund’s positioning has worked in its favor thus far, it carries more risk than before. That is more complexity and risk than one would normally expect from a core, intermediate-term bond portfolio and is the primary driver behind the fund’s Analyst Rating of Neutral.”

Jacobon was quoted in the Wall Street Journal on October 5, 2011 to the same effect:

“The risks, however, are far different from those in a plain-vanilla bond fund, where the primary concerns are the direction of interest rates and credit quality. For starters, the privately backed CMOs are highly illiquid and their prices fall during periods of risk aversion. The government-issued mortgage-backed securities help balance the risk by gaining in value when investors panic. The fund also recently had more than 17% of its assets in cash, up from about 7% in 2010.

“But even that isn’t a guarantee that Mr. Gundlach will navigate the treacherous landscape unscathed. He is holding more risky assets than he did during other treacherous periods — and a double-dip recession, a further slide in housing prices or a default in Europe could harm his privately backed securities, says Eric Jacobson, director of fixed-income research for Morningstar. “He’s tremendously confident that he can move around this,” Mr. Jacobson says. “But it may not matter how nimble he is if we end up with a big selloff too quickly.” ”

Fact or Fiction? Here is a sector breakdown of the holdings of DBLTX as of the end of November: http://www.doublelinefunds.com/funds/total_return/statistics.html

Non-Agency MBS: As you can see from the sector breakdown for DBLTX, non-Agency RMBS accounted for ~35% of the portfolio as of the end of November 2011. While managing TGLMX, after the credit meltdown created the distressed-price opportunity in the non-Agency sector, Gundlach and his team invested ~50% of the portfolio in non-Agency RMBS. This fact was attested to by Morningstar in 2009 (a year for which Gundlach and the fund were nominated Fixed Income Manager of the Year and Fixed Income Manager of the Decade). A Morningstar analyst report on TGLMX (The fund Gundlach & team ran at TCW) by Lawrence Jones, dated January 7, 2009:

“Additionally, beyond the fund’s solid defensive characteristics, Gundlach and Barach sought to take advantage of steep price declines in parts of the mortgage market. Specifically, the team purchased higher-quality (currently AAA rated) nonagency mortgage securities (near 45% of assets) at price levels where management thinks the issues offer strong total return potential even with significantly added stress on the housing and mortgage markets.”

Tell me readers: Is a non-investment grade bond (BB or lower) “risky” no matter what? Little known to many, astute investors such as Seth Klarman, Kyle Bass and Daniel Loeb have been big buyers of non-agency MBS. The reason? A huge margin of safety exists. Draconian default and loss assumptions are built in before purchasing these bonds. Even if things get worse (DoubleLine stated they use a base case of housing declining ~15% further) attractive returns will still be realized. The catalyst of maturity is powerful, each dollar pre-payed is received at par. So if you buy a bond at $0.60 on the dollar and $0.65 is returned to you in addition to your coupon, that’s a pretty attractive return. It’s only “toxic” and “risky” to the person who holds it at par. If you compare these “Loss Adjusted Returns” to HY bonds for instance – one very key point may be missed. That is, HY bonds are being run to historically low default figures. Not an apples to apples comparison. When you build in such extreme scenarios into these bonds, it becomes difficult to lose – and outstanding risk/return profiles are created.

Fact or Fiction #2: DoubleLine holds large amounts of “esoteric” bonds. I obtained the following updated Agency CMO breakdown from DoubleLine Capital:

Inverse Floaters 6%

Floaters 0%

Principal Only 0.1%

Interest Only 0.1%

Inverse IO 3%

Z tranche CMO 15%

Other CMO 7%

Are these positions unprecedented for the way Jeffrey Gundlach ran the TGLMX fund at TCW? The public filings say “no”, but let’s look at what Morningstar themselves said:

1. Eric Jacobson, December 6, 2002 Fund Analysis Report: “Gundlach holds 27% in CMOs but is particular about which slices he buys, shunning PAC bonds many rivals covet for their reputed stability. Rather, Gundlach tends to focus on either simple structures or some of the riskier looking pieces such as inverse floaters (recently 6%), depending on what looks cheap.”

2. Jacobson, February 21, 2003: “That style owes to the inefficiencies that manager Jeffrey Gundlach and his colleagues see as inherent in the mortgage market. They typically express that view by holding less-common subsectors such as simple-structure agency CMOs, private-label CMOs (9.7% in December), adjustable-rate mortgages (25%), and even inverse floaters (5%).”

3. Jacobson, January 27, 2003: “Lead manager Jeffrey Gundlach and his colleagues are fans of the mortgage market, and what they see as its inefficiencies. They typically express that by holding less-common subsectors such as simple-structure agency CMOs, private issue CMOs (recently 14%), adjustable-rate mortgages (16%), or even inverse floaters (6%).”

Back to our original argument; Jacobson and the Morningstar team have argued that DBLTX is risky because they employ certain amounts of esoteric risky securities. As shown above, that is clearly false. Dolan’s comments are also proven false as it is clearly not a change from the past management style.

Overall Risk: The beauty of the DoubleLine managed funds is that the team is NOT trying to guess interest rates. They have cleverly devised a strategy that takes advantage of extreme dislocations in the RMBS market and paired them with longer duration agency securities that perform well if rates stay flat or move lower.

I would actually argue that the funds nominated are actually RISKIER for a number of reasons.

1. They are higher duration versus DoubleLine

2. With Agency MBS at record highs and the average bond prices for these funds well above par, they are exposed to significant pre-payment risk if elevated levels of refinancings persist or an Obama refi program is enacted. As DoubleLine’s average price is ~$0.95 – they would benefit from prepayments.

3. DoubleLine is generating much more income than these funds providing additional cushion for market volatility.

4. Whereas DoubleLine will benefit from an economic recovery/rates moving higher from their negative duration RMBS, the competitors do not have this type of dual risk pairing.

Performance in Rising & Falling Rate Scenarios:

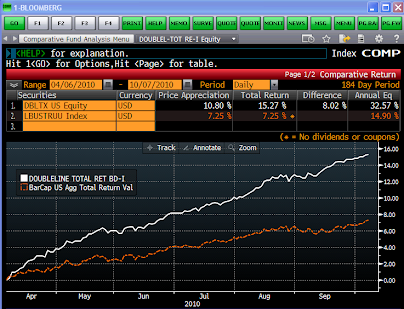

Falling rates: DBLTX April 4, 2010 inception through October 7, 2010:

Rising rates: DBLTX and DBLTX October 7, 2010 through February 8, 2011:

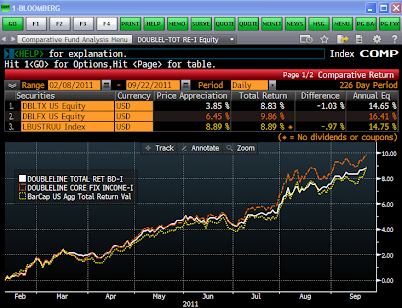

Falling rates: DBLTX and DBLFX February 8, 2011 through September 22, 2011:

Cumulative Performance Since Inception vs Barclays Index

Conclusion: Did I really spend all of this time writing about DoubleLine and Morningstar because they didn’t nominate DBLTX for an award? Of course not, but it begs two questions that are equally as troubling/concerning:

- Is the analysis coming out of Morningstar so inept and faulty that they are this far off base? Morningstar has seemingly changed their view continuously over the past few years as evidenced above.

- Fidelity and PIMCO were the only two funds nominated for these awards and are both large advertisers for Morningstar. Is Morningstar showing favoritism towards these advertisers? It appears possible as we have already established that the performance is inferior and it’s actually more risky.

If you prescribe to some combination of the above, which is what I think is likely, it is quite disappointing. In a time period of so much unoriginal thought, it is mind boggling that one of the true alpha producers in the industry can be so misunderstood.

***12/30/2011 Update: Last week Morningstar issued a “correction” located in the footnotes of their website. You can view the link here. This was clearly in response to this blog post point this very fact out, which according to Google Analytics, was a popular view in the Morningstar offices. While it is certainly appropriate that they made this correction, it still appears to be insufficient.

In my experience these sort of corrections are usually made for analyst that has accidentally fat-fingered a number or misstated something. In this case, I am unsure how their fixed-income staff could make such a blatant error. It would be the equity equivalent to an analyst stating that a mutual fund is up big because the Dow and S&P are up big – something we know clearly isn’t true.***

In summary, I am pleased that Morningstar has admitted some degree of error in their judgement but feel this is just one minor aspect of poor analysis and/or biased research.

Disclosure: I am a holder of the DoubleLine Total Return Fund and otherwise have no other affiliation with DoubleLine Capital. The sources of the above quotes can be found at the links below:

TGLMX Morningstar Report

Nominees For Fixed Income Manager of the Year