The year is 2010. Bill plans to retire next month after working at the same company for thirty years. Over that time, he amassed a 401(k) account balance of approximately $2 million. After retirement, Bill plans to find a financial professional and roll his 401(k) into an IRA. He does some research and settles on XYZ Adviser, a joint broker/dealer and investment adviser. XYZ suggests that Bill roll his 401(k) into an account at their firm, where it will be invested in stocks, bonds, and various mutual funds.

[REITs]As he reads his contract with XYZ, Bill notices some language that says XYZ’s rollover recommendation was a “one-time recommendation” and that their advice “did not form the primary basis” of Bill’s decision to roll over his 401(k). Bill does not think much of it. After all, he has built good rapport with his new adviser and trusts him to make decisions in his best interest. Bill signs the contract and rolls his 401(k) into an account at XYZ.

Was XYZ acting as a fiduciary when it recommended that Bill make the rollover? The answer is “probably not,” because the fiduciary standard in force in 2010 required recommendations to be made on a “regular basis” and to form the “primary basis” for a rollover before they became fiduciary recommendations.

Most people have heard that there is a new Fiduciary Rule (the Rule) in place, but many are not familiar with what is “new” about it or why it changed in the first place. This lack of familiarity is due in part to the new Rule’s significantly expanded scope. There are now many more entities that fit the regulatory definition of “fiduciary,” which went into effect on June 7, 2016. The remainder of the Rule, dealing with prohibited transactions and related exemptions, is currently set to take effect on July 1, 2019. But what were the standards under the old Fiduciary Rule and why did the Department of Labor (DOL) feel that a broader definition of fiduciary was necessary?

The Old Rule

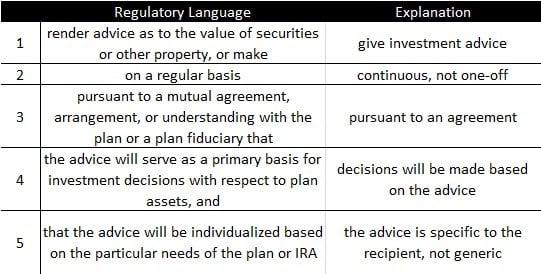

The old Fiduciary Rule consisted of a five-part test to determine whether an entity was a fiduciary. Under the old Rule, for advice to constitute “investment advice,” an adviser had to:

While Bill and XYZ advisers are fictional entities, the DOL cited real examples just like them in its rationale for the new Rule, specifically mentioning how the “regular basis” and “primary basis” parts of the old Rule were abused. Regarding the “regular basis” requirement, the DOL noted how it deprived “IRA owners of statutory protection when they seek specialized advice on a one-time basis, even if the advice concerns the investment of all or substantially all of the assets held in their account.”

Similarly, the DOL noted that many financial entities marketed themselves as providing individualized investment advice, “while at the same time disclaiming in fine print the requisite ‘mutual’ understanding that the advice will be used as a primary basis for investment decisions.” Many financial entities used these strategies to avoid fiduciary responsibility. Thus, the DOL felt it needed to promulgate a new rule to compensate for the “absence of adequate fiduciary protections and safeguards.”

The New Rule

The new Fiduciary Rule broadens the scope of fiduciary advice by doing away with the old five-part test and replacing it with fewer criteria. In other words, it widens the fiduciary “door” by lowering the number of criteria a recommendation must meet to get in. We have discussed the new Rule extensively, and the full text of the new regulation defining “fiduciary” is available online.

The new Rule takes a two-step approach to determining whether a communication is fiduciary investment advice. First, it defines which types of recommendations constitute “investment advice.” Second, it establishes the types of relationships that must exist for such recommendations to give rise to fiduciary investment advice responsibilities. Regarding the first step, the new Rule specifically defines rollover recommendations, even one-time recommendations, as fiduciary investment advice.

Next, the second step states that a person is rendering fiduciary investment advice if he (1) acknowledges that he is acting as a fiduciary, (2) renders advice pursuant to an agreement that the advice is individualized to the recipient, or (3) directs the advice to a specific recipient regarding the advisability of a particular decision with respect to the property of a plan or IRA. In summary, a fiduciary relationship exists if the adviser acknowledges his fiduciary status or if he gives individualized advice to a specific person about his or her IRA or retirement plan account.

Under the new Rule, the hypothetical interaction between Bill and XYZ Adviser plays out quite differently. In our hypothetical scenario, XYZ recommended that Bill put his rollover IRA under XYZ’s management where it would be invested in stocks, bonds, and various mutual funds. Thus, the recommendation would satisfy the first step of the new Rule because it was a recommendation as to how securities should be invested after they are rolled over.

Next, XYZ directed its advice to a specific recipient, Bill, regarding the advisability of a rolling his 401(k) account into an IRA. Thus, XYZ would satisfy the second step of the new Rule, which means that XYZ and Bill have the type of relationship that triggers fiduciary responsibility.

Notably, XYZ Adviser can no longer avoid fiduciary responsibility because its rollover advice is a one-time event. Nor can XYZ issue a contract that disclaims that its advice was the primary basis for the rollover decision. Instead, XYZ’s rollover recommendation would be considered fiduciary investment advice, and XYZ would have to seek one of the new Rule’s exemptions before making the recommendation. We explained that procedure in more detail in our article “Advisers Take Note: The Fiduciary Rule Puts Rollovers Under a Microscope.”

Black Cypress’s Response to the New Rule

At Black Cypress, we strive to provide our clients with individualized advice that they can rely on, rather than requiring them to affirm some other source as the primary basis for their investment decisions. Unlike the fictional XYZ Adviser, Black Cypress does not attempt to avoid fiduciary responsibility through clever language in fine print. Rather, we have transparent relationships with our clients so that they trust us to act in their best interests. The rules have changed, but our service to clients has not. If you would like more information about our individualized advice or how we put our clients first, please contact us at [email protected] or 843-259-2009.

Article by Jordan M. Roberts, Black Cypress Capital Management