Rent spikes are increasing for more small business owners as 2023 proceeds, breaking a new record: 54% say they’re paying more now than they did six months ago. And 14% say their rent is over 20% higher than it was in December.

Small Businesses Are Facing Rent Spikes

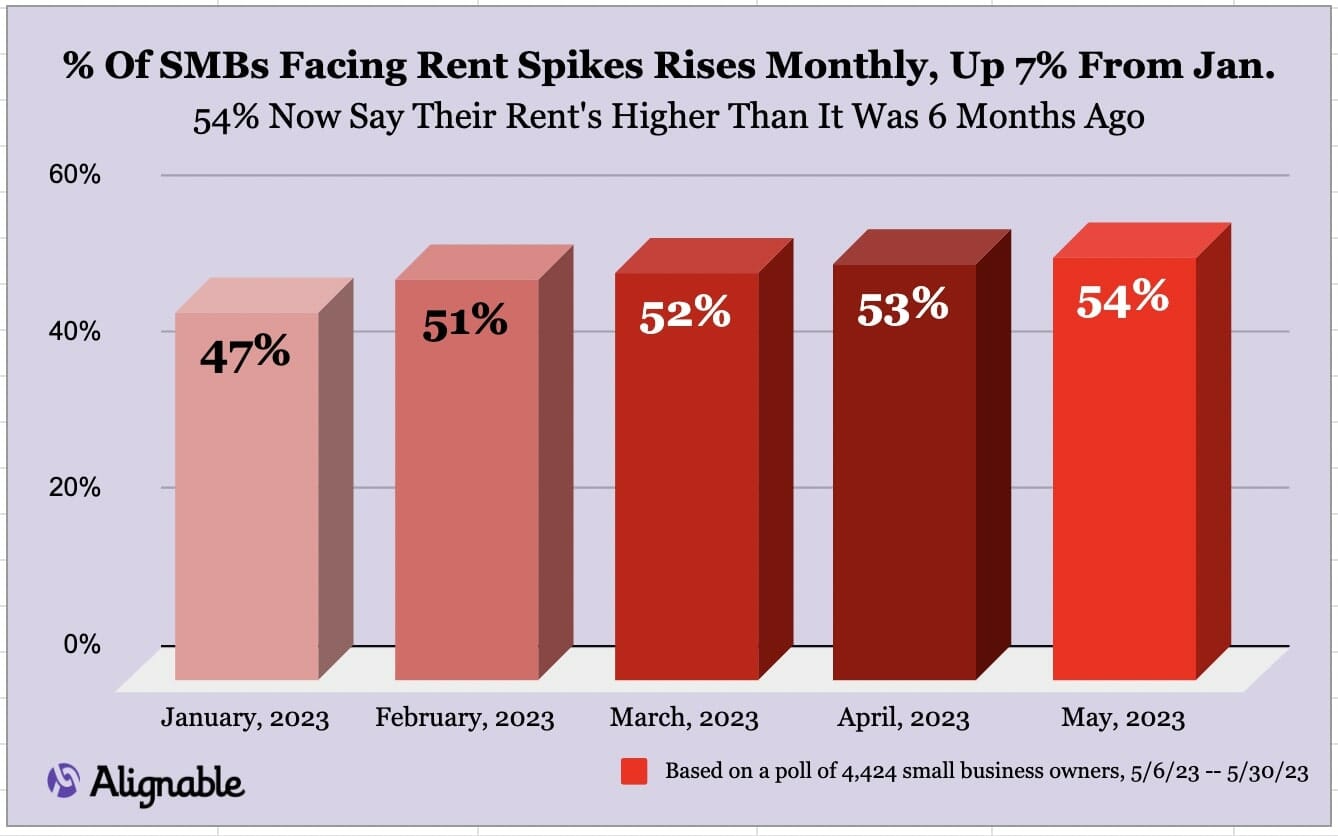

The 54% figure represents a steady climb in the number of small businesses dealing with higher rent prices each month in 2023 — up seven percentage points from 47% in January, as this chart indicates.

Making matters worse, the average revenues small business owners are earning are dropping, as rents are rising, creating intensifying financial pressure, exacerbated by other economic challenges including still-high inflation, increasing interest rates, and greater recessionary fears.

This pressure is so severe that 37% of small business owners in the U.S. report they couldn’t afford to pay their rent in full and on time this month, according to Alignable’s May Small Business Rent Report, which has just been released.

This report is based on Alignable’s new poll of 4,424 randomly selected small business owners from 5/6/23 to 5/30/23, as well as data from 75,000+ other responses chronicled from surveys over the past 18 months. Alignable’s Research Center uncovered other trends including that:

- 57% of minority SMB owners couldn’t pay May’s rent (representing the worst surge of the year so far, up 9 percentage points from 48% just a month ago)

- Several states broke 2023 records for rent delinquency rates in May:

- IL — 52% of SMBs could pay May rent (up 11% over Apr.)

- NY — 48% (up 6% vs. Apr.)

- MN — 47% (up 2% vs. Apr.)

- CA — 41% (up 9% compared to last month)

- Meanwhile, only 7% of Arizona’s small businesses couldn’t handle May rent payments, down eight percentage points from Apr. Arizona has the lowest rent delinquency rate among SMBs in the U.S.

- 45% of retailers struggled to make May rent (up 4%)

- 47% in the travel/lodging arena experienced the same issue — up 20 percentage points over last month

- While the national average for the U.S. in May was 37%, it was even worse in Canada, with 53% of businesses north of the U.S. border reporting rent delinquency.

- Beyond rent spikes, revenues are also lower in May — 45% of SMBs say they earned half or less of what they generated monthly prior to COVID. In April, that figure was only 39%.