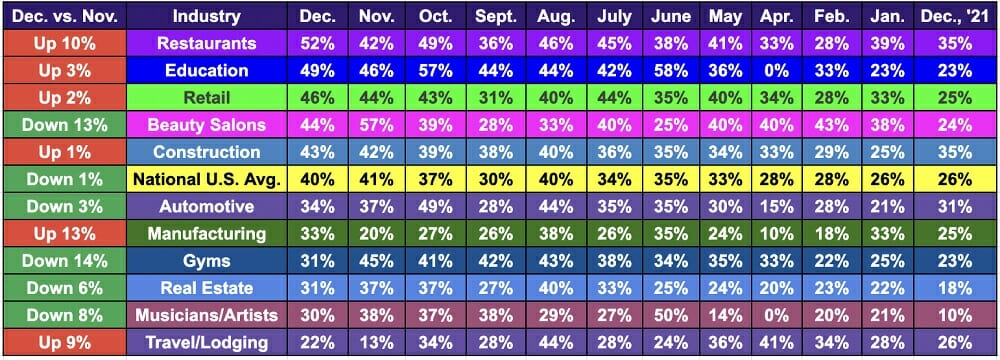

Alignable’s December Rent Report is out today and the news continues to be discouraging. 2022 has had its ups and downs, but the year’s ending on a depressing note for many small businesses. While December’s rent delinquency rate didn’t break a record, it remains very high at 40%, just one percentage point shy of November’s 41% rate, the record for 2022.

Q3 2022 hedge fund letters, conferences and more

What’s even more daunting is that last December, small businesses had something to celebrate: only 26% had rent troubles – the lowest rate for all of 2021. In stark contrast, today the U.S. national average is up 14 percentage points over last year.

These findings are based on Alignable’s poll of 3,252 small business owners surveyed from 12/10/22 to 12/29/22, as well as sentiments of 65,000+ other SMB owners during 2022.

Despite a slightly improved inflation rate, the majority of small business owners remain concerned about the cumulative effects of high inflation, saying it continues to take a toll on their businesses. Rising rents and interest rates, plus reduced consumer spending are also impediments to small business success this month.

This all adds up to another major finding in December’s report: 38% of small businesses say they have only one month or less of cash reserves right now. This figure is up 12 percentage points from just 26% in December 2021, and represents an all-time high for 2022.

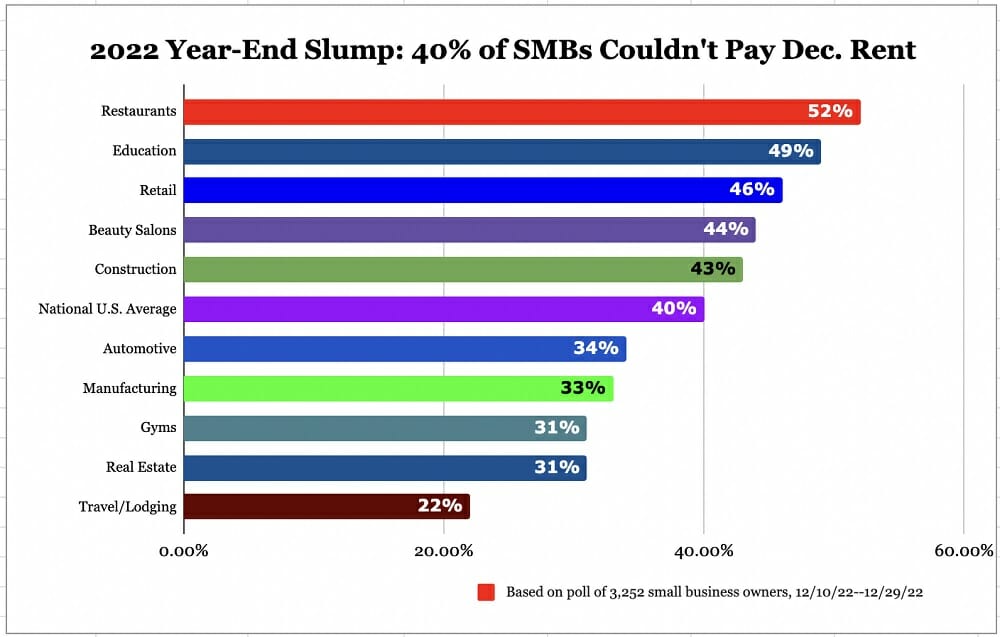

40% Of U.S. Small Businesses Couldn’t Pay Their December Rent

Here are a few more highlights:

- Only 21% of SMBs have fully recovered financially, making as much or more than they did monthly prior to COVID. This is down 22 percentage points from Dec. ‘21, when it was 43%.

- Retailers, restaurants, & construction companies broke rent delinquency records for 2022 this month, unable to pay their full rent:

- 46% of Mom & Pop retailers (up 2%)

- 52% of restaurateurs (up 10%)

- 43% in construction (up 1%)

- 52% of all SMBs say their rent is higher than it was six months ago

- 64% say consumer spending is down this month compared to Nov.

- 76% say they’re worried about rising interest rates hurting their business growth, with 41% being “highly concerned”

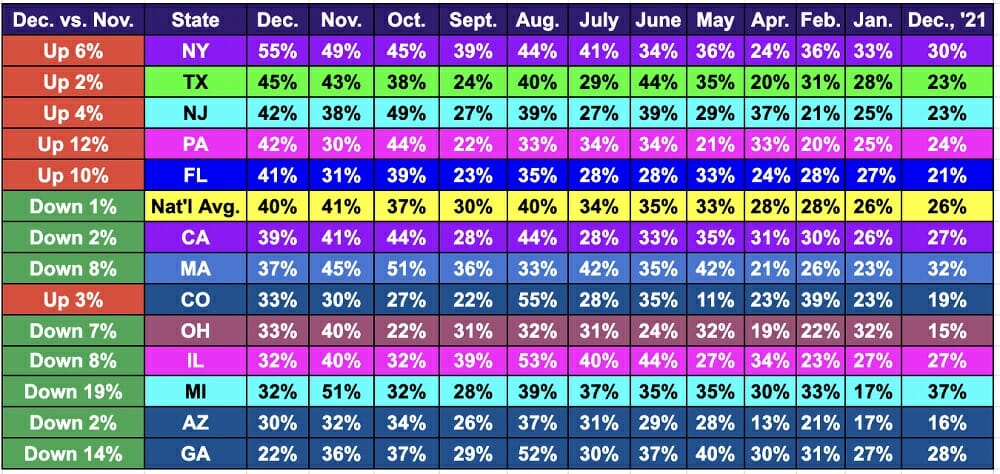

- New York leads the pack of states that broke rent delinquency records in Dec., with 55% unable to cover rent in full. Texas at 45% & Florida at 41% also broke state delinquency records for 2022.

- In Canada, there was some good news. Like the U.S., 40% couldn’t pay their Dec. rent, but that was a five percentage point improvement over Nov. for Canadian small businesses. However, 54% of BC-based small businesses couldn’t pay Dec. rent.

To see the full report, go here.