“Worldwide M&A activity totals US$3.6 trillion during YTD 2020, down 5% compared to the same period last year and nearly erasing the 41% YoY decline at the half year mark. The YTD M&A tally marks the lowest YTD period for deal making since 2017 (US$3.2 trillion). By number of deals, worldwide deal making has fallen 4% so far this year, a four-year low. With two consecutive quarters to surpass US$1 trillion, second half 2020 deal making activity totals US$2.3 trillion, an 88% increase compared to the first half of this year and the strongest consecutive semi-annual increase on record. (The previous record was a 46% increase in the second half of 1997.) 20H2 also marks the strongest second half, by value, since records began in 1980,” comments, Matt Toole, Director of Deals Intelligence, Refinitiv.

Q3 2020 hedge fund letters, conferences and more

Record Second Half M&A Surpasses US$2 trillion, Up 88% from H1

- Full Year 2020 M&A down 5% to 3-year low, nearly erasing the 41% YoY decline at the half year mark

- US M&A decreases 21% to 3-year low; Europe deal making up 34%; Asia Pacific M&A up 15%

- MEGA DEALS: Record number of mega deals during 20H2

- Technology, Financials, Energy & Power and Industrials lead 2020 deals

- SPACs: Record US$78.6 billion raised via 254 SPAC IPOs during 2020, more than 5x more than 2019

- PE-backed buyouts up 20%; highest percentage of M&A since 2007; Record number of deals

- Cross-border deal making up 12%; Emerging Markets M&A down 7%

- Goldman Sachs maintains top spot for WW, US and European M&A; China International Capital takes top spot in Asia Pacific

Record Second Half M&A Surpasses US$2 trillion, Up 88% from H1; Full Year 2020 M&A Down 5% to Three-Year Low,Nearly Erasing the 41% Year-over-Year Decline at the Half Year Mark

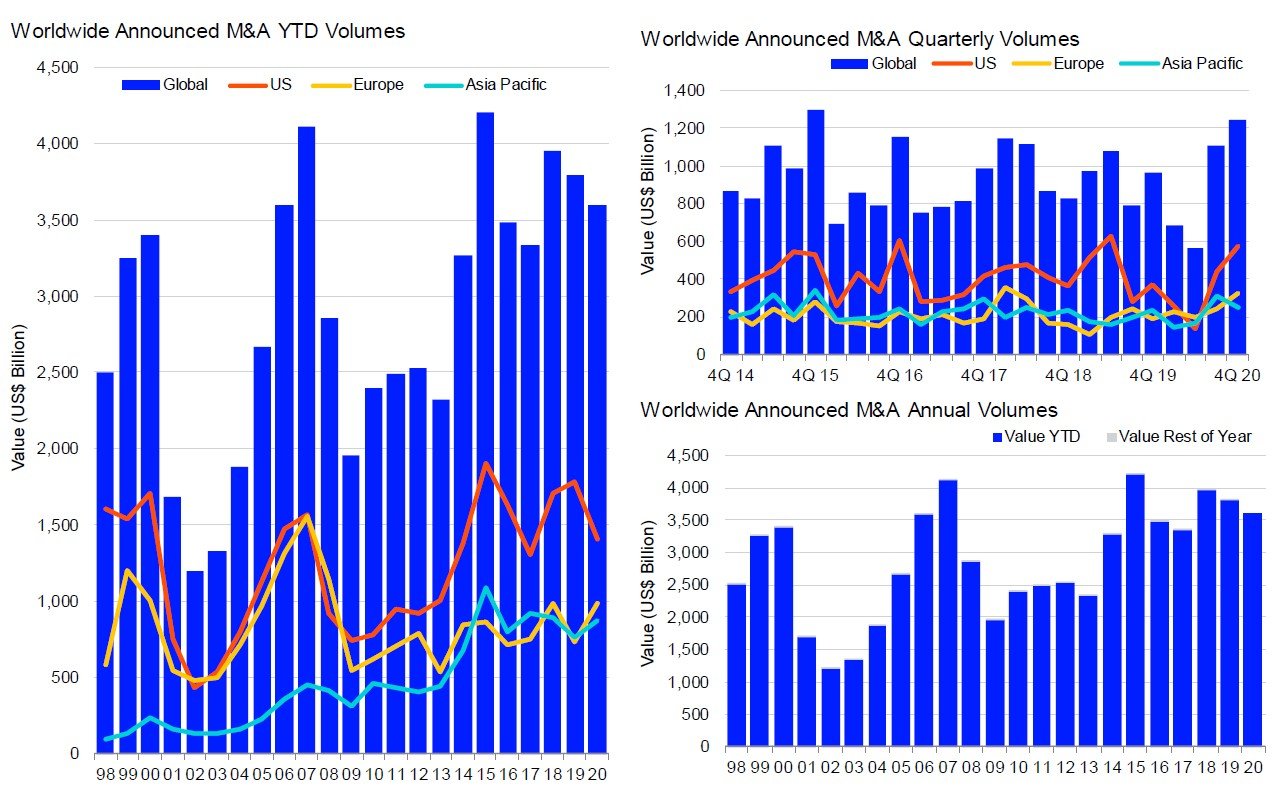

Worldwide M&A activity totals US$3.6 trillion during year-to-date 2020, down 5% compared to the same period last year and nearlyerasing the 41% year-over-year decline at the half year mark. The year-to-date M&A tally marks the lowest YTD period for deal making since 2017 (US$3.2 trillion). By number of deals, worldwide deal making has fallen 4% so far this year, a four-year low. With two consecutive quarters to surpass US$1 trillion, second half 2020 deal making activity totals US$2.3 trillion, an 88% increase compared to the first half of this year and strongest consecutive semi-annual increase on record. (The previous record was a 46% increase in the second half of 1997). Second half 2020 also marks the strongest second half, by value, since records began in 1980. Global M&A for deals greater than US$10 billion has decreased 21% compared to the same period last year, while deals between US$5-US$10 billion have increased 36%, by value, and increased 38%, by number of deals, compared to 2019.

U.S. M&A Decreases 21% to Three-Year Low; Europe Deal Making Up 34%; Asia Pacific M&A Up 15%

M&A in United States has hit US$1.4 trillion so far this year, a decrease of 21% compared to the same period last year and a three-year low. Bolstered by six of the largest worldwide deals announced during the year, including the $107 billion dual-headed share unification for Unilever PLC, M&A in Europe has reached US$988.6 billion so far this year, up 34% compared to a year ago. Asia Pacific M&A activity totals US$871.5 billion, up 15% from year-to-date 2019 and the strongest year-to-date period for M&A in the region in two years.

Technology, Financials, Energy & Power and Industrials Lead 2020 Deals

Deal making targeting the Technology sector hit a record US$679.2 billion so far in 2020, up 49% compared to year-to-date 2019 and a record 19% of total activity. M&A in the Financials sector totaled US$489.6 billion so far during 2020, down 6% compared to last year at this time. Energy & Power deal making accounts for 12% of year-to-date activity and is down 13% compared to a year ago. Deal making in the Industrials sector accounts for 11% of global M&A so far this year with US$400.6 billion of deals announced, down 10%.

PE-backed Buyouts Up 20%; Highest Percentage of M&A Since 2007; Record Number of Deals

Global private equity-backed M&A activity totaled US$570.0 billion during year-to-date 2020, a 20% increase compared to last year and the strongest year-to-date period for global buyouts since 2007. Private equity deals account for 16% of overall M&A, up from 13% during year-to-date 2019 levels and a 13-year high. Private equity-backed M&A targeting the United States reached US$211.0 billion so far during 2020, an increase of 6% compared to 2019 levels. Over 8,600 private equity-backed M&A deals were announced during year-to-date 2020, an all-time record.

Cross-Border Deal Making Up 12%; Emerging Markets M&A Down 7%

Cross-border M&A totaled US$1.3 trillion during year-to-date 2020, a 12% increase compared to last year and the strongest periodfor cross-border deals since YTD 2018 (US$1.5 trillion). Cross-border activity accounts for 35% of total M&A activity this year, up from 30% a year ago. The United States and United Kingdom initiated 46% of all acquisitions abroad so far in 2020 with US$581.8 billion in deals, while China outbound acquisitions account for 3% of cross-border activity. M&A involving emerging markets totaled US$924.7 billion so far during year-to-date 2020, a 6% decrease compared to a year ago.

Goldman Sachs Maintains Top Spot for WW, US and European M&A; China International Capital Takes Top Spot in Asia Pacific

Goldman Sachs maintained the top position for worldwide announced M&A advisory work during year-to-date 2020 boosted by the top ranking in the United States and Europe. while China International Capital took the top spot in Asia Pacific; Morgan Stanley took first place in Japan. Led by Evercore Partners, Lazard and Rothschild, nine independent advisory firms placed among the top 25 global financial advisors during year-to-date 2020.

Worldwide M&A Volumes

WW M&A Declines 5%; H2 Up 88%

Worldwide M&A activity totals US$3.6 trillion during year-to-date 2020, down 5% compared to the same period last year. The year-to-date tally marks the lowest YTD period for deal making since 2017 (US$3.3 trillion). By number of deals, worldwide deal making has fallen 4% so far this year, a four-year low. Global M&A for deals greater than US$10 billion has decreased 21% compared to the same period last year, while deals between US$5-US$10 billion have increased 36%, by value, and increased 38%, by number of deals, compared to a year ago. With two consecutive quarters to surpass US$1 trillion, second half 2020 deal making activity totals US$2.3 trillion, an 88% increase compared to the first half of this year and strongest consecutive semi-annual increase on record. (The previous record was a 46% increase in the second half of 1997).

U.S. M&A Falls 21%; H2 Nearly Triples

United States year-to-date M&A activity hit US$1.4 trillion, down 21% compared to last year and is the country’s slowest full year period for deal making since year-to-date 2017 (US$1.3 trillion). By number of deals, YTD 2020 has produced 12,063 deals, a 5% increase compared to year-to-date 2019 and a two-year high. Fourth quarter-to-date M&A activity in the U.S. totals US$575.9 billion, up 32% from the third quarter, as U.S. M&A activity in the second half of 2020 increased 157% compared to the first half.

Europe M&A Increases 34%

Bolstered by six of the largest worldwide deals announced during 2020, including the $107 billion dual-headed share unification for Unilever PLC, M&A in Europe has reached US$988.6 billion so far this year, up 34% compared to a year ago and a 12-year high. There have been just over 13,500 European deals announced year-to-date, a 16% decline compared to last year and the lowest YTD number of deals since 2013.

Asia Pacific Deal Making Up 15%

Asia Pacific M&A activity for YTD 2020 totals US$871.5 billion, up 15% from year-to-date 2019 and a two-year high. Asia Pacific accounts for 24% of worldwide merger activity, up from 20% during the year ago period.

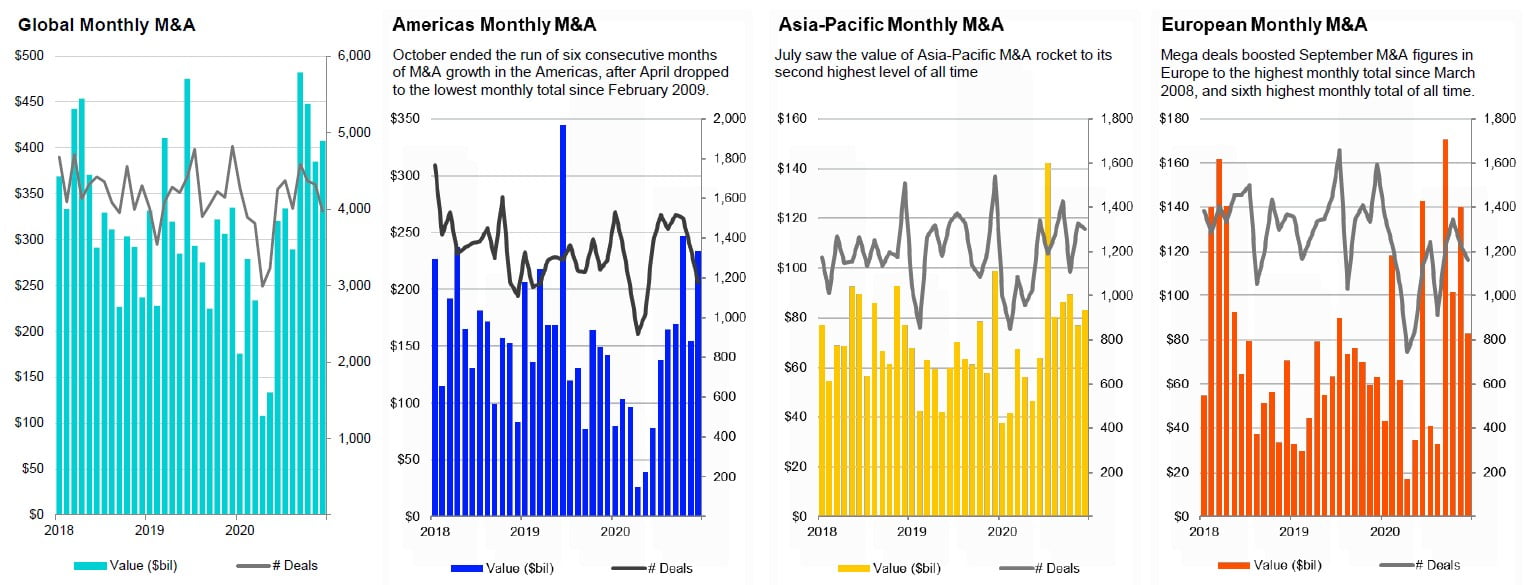

Monthly Worldwide M&A Activity

The value of worldwide M&A activity plummeted in April to the lowest monthly level in almost 16 years. Activity remained muted in May, dragging the value of deals announced during the first half of 2020 down to just $1.25 trillion, down 39% from the previous year and the lowest first-half total since 2013. M&A rebounded strongly over the summer, with every month during the second half of the year recording gains over the same month in 2019. Deals announced during September reached US$482.0 billion, more than double the value recorded during the same month last year and the sixth highestmonthly total since our records began. The year finished with two trillion-dollar quarters, resulting in a $2.3 trillion second half, the highest second-half total of all time.

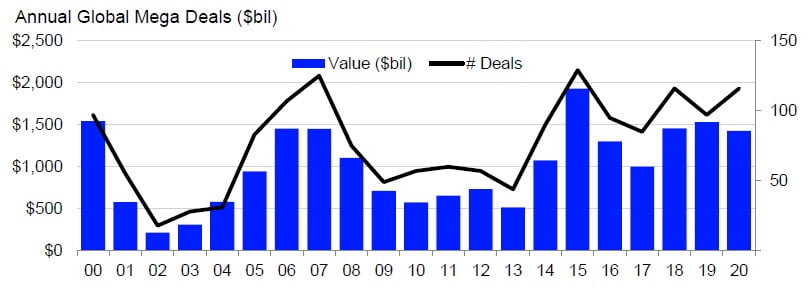

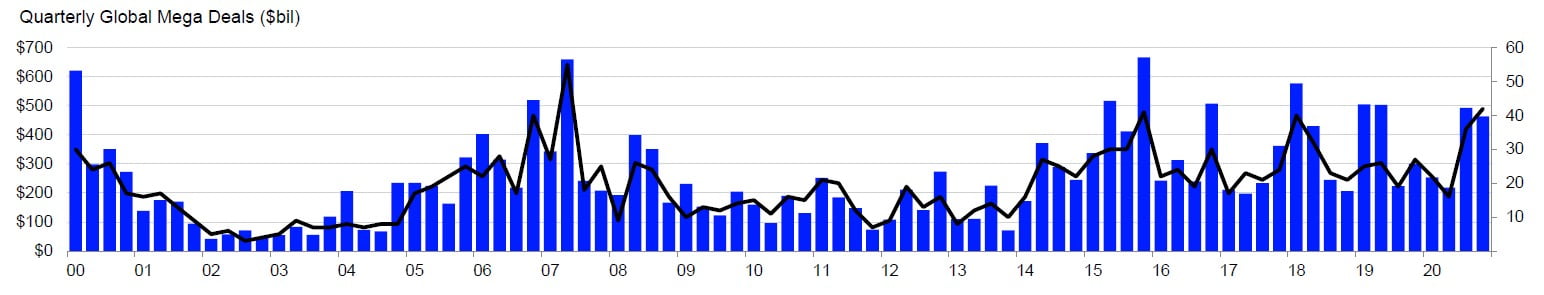

Mega Deals: Record Number of Mega Deals During Second Half of 2020

Seventy-eight deals worth US$5 billion or more have been announced during the second half of 2020, the highest second-half tallyfor mega deals of all-time.

116 mega deals have been announced so far during 2020, up from 97 during 2019 and only exceeded three times since our recordsbegan.

- Seventy-eight mega deals ($5bil+) have been announced so far during the second half of 2020, the highest second half tally since our records began in the 1970s, and only exceeded once during the first half of any year, in 2007. The combined value of mega deals announced since July 1st, 2020 is US$955.6 billion.

- Compared to other quarterly tallies, the number of mega deals recorded so far during the fourth quarter of 2020 has only been exceeded once during any quarter since our records began (Q2’07).

- 20 mega deals were recorded in October alone, the second highest monthly tally of all time.

- 116 mega deals have been announced so far during 2020, up from 97 during 2019 and only exceeded three times since our records began, in 2018(116), 2015(129) and 2007(125).