Amid the COVID-19 pandemic, thousands of startups all over the world are running out of cash. Venture capital firms have grown reluctant to open their wallets. Many startups are doing everything they can to conserve cash in the coronavirus-induced economic turmoil. But things were entirely different in 2019. Here we take a look at the top 10 most active VC firms in the world. The ranking is based on data from PitchBook and CrunchBase for the full year 2019.

Q1 2020 hedge fund letters, conferences and more

According to CrunchBase, VC firms poured a staggering $1.5 trillion into startups between 2010 and 2019. In 2019 alone, venture capitalists invested a little over $294 billion in 32,800 deals of different sizes. In most startup funding rounds, there is typically a lead investor and a bunch of other investors.

Some VC firms and startup accelerators invest relatively smaller amounts in hundreds of startups. Others, mostly late-stage investors, write bigger checks for an equity stake in a select few startups. It won't be fair to put the seed-state and late-stage investors in the same bucket.

So, let's first look at the most active VC firms overall based on the total number of deals. And then we'll check out the most active firms in different stages of startup funding.

Most active VC firms: Overall

500 Startups remains by far the most active venture capital firm in the world with 285 deals. It has $565 million in committed capital. The second-ranked Enterprise Ireland is an Irish government agency that supports Irish companies including startups.

This ranking is dominated by startup accelerator programs and angel investor networks such as 500 Startups, Y Combinator, and Keiretsu Forum.

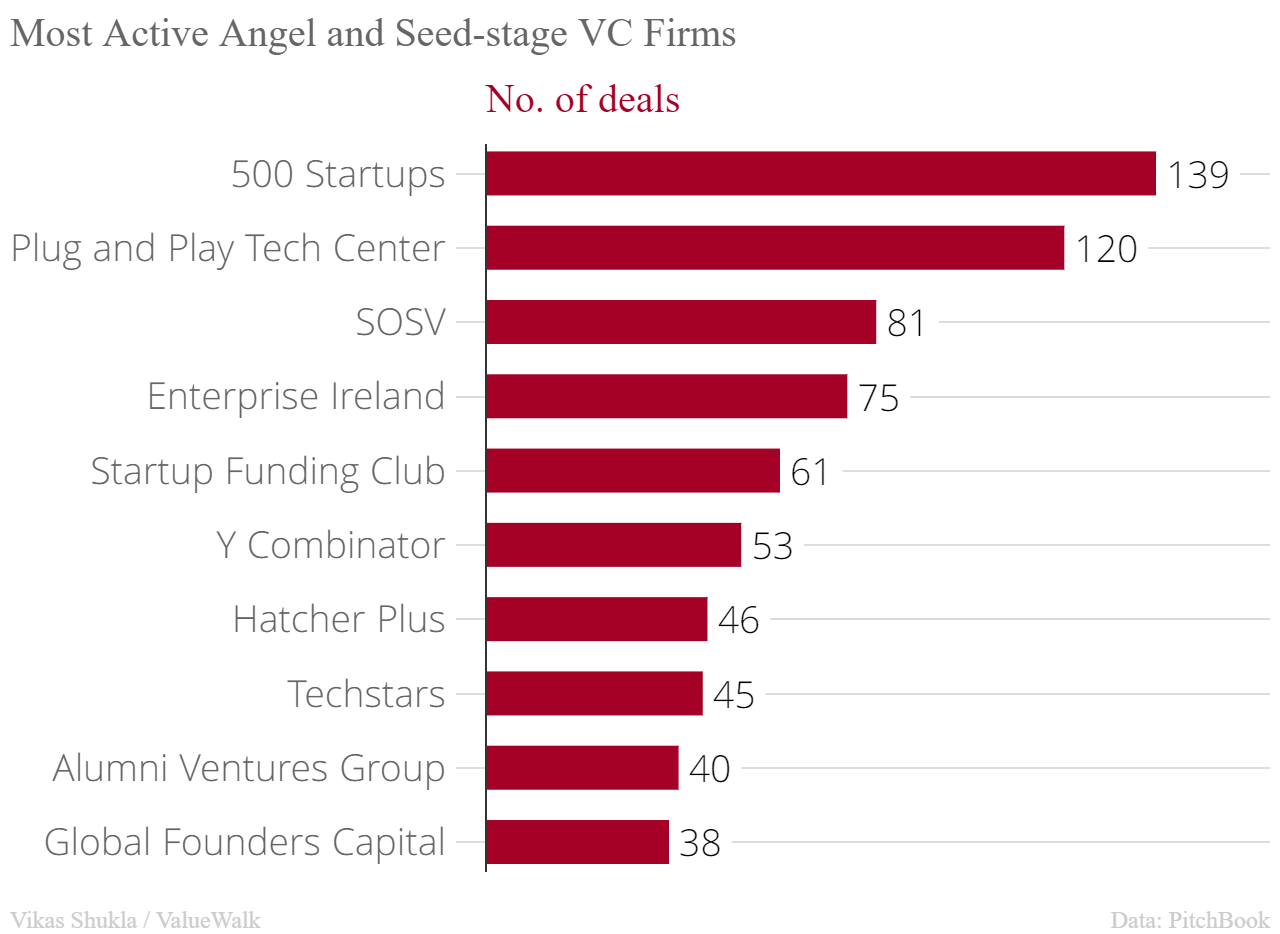

Most active angel and seed-stage venture capitalists

According to CrunchBase, the year 2019 witnessed a record 20,434 angel and seed-stage funding rounds worldwide. In the pre-seed, seed, and angel stages, VCs and accelerators invest under $5 million in startups that have a proof of concept and some market validation.

The most active angel and seed-stage investors are accelerator programs that not only invest in but also help nurture startups. Topping this list is again 500 Startups.

Most active early-stage VC firms

Early-stage funding typically includes Series A, Series B and other rounds under $15 million. Here's the interesting thing - Accelerator programs that took an equity stake in exchange for a small amount of money also participate in the Series A and Series B rounds of graduating startups. It's part of the accelerator's term sheets.

Accelerator programs such as Y Combinator and 500 Startups, and angel networks such as the Keiretsu Forum often set aside some money to invest in the later stages of their alumni startups. But they rarely go beyond Series B.

Most active late-stage VC firms

Late-stage funding rounds are Series C and later where startups typically raise $15 million or more (sometimes billions) to expand their operations, venture into new territories, stabilize their business, and foray into other verticals.

According to PitchBook, the most active late-stage VC firms are Keiretsu Forum, Accel, and Tiger Global Management. According to CrunchBase, the average deal size in late-stage funding rounds was $85.7 million in the fourth quarter of 2019. There were a total of 2,450 late-stage and technology growth deals in 2019.

Remember that investing in promising startups is only one aspect of the venture capital funding. Another important aspect is to invest at the right valuations. Just ask SoftBank's Masayoshi Son. He invested nearly $20 billion in a startup that is currently worth $2.9 billion. His another promising investment Oyo is also turning sour.

Finally, VC firms invest in startups with a plan to exit, typically within 5-12 years. That's when they convert their equity stake into cash. VCs exit startups via mergers & acquisitions (M&A) and initial public offerings (IPOs). Last year, 500 Startups exited 41 investments and Y Combinator exited 38. Occupying the third spot was Plug and Play Tech Center with 30 exits.