Three Warren Buffett Tech Stocks to Buy by Harvi Sadhra

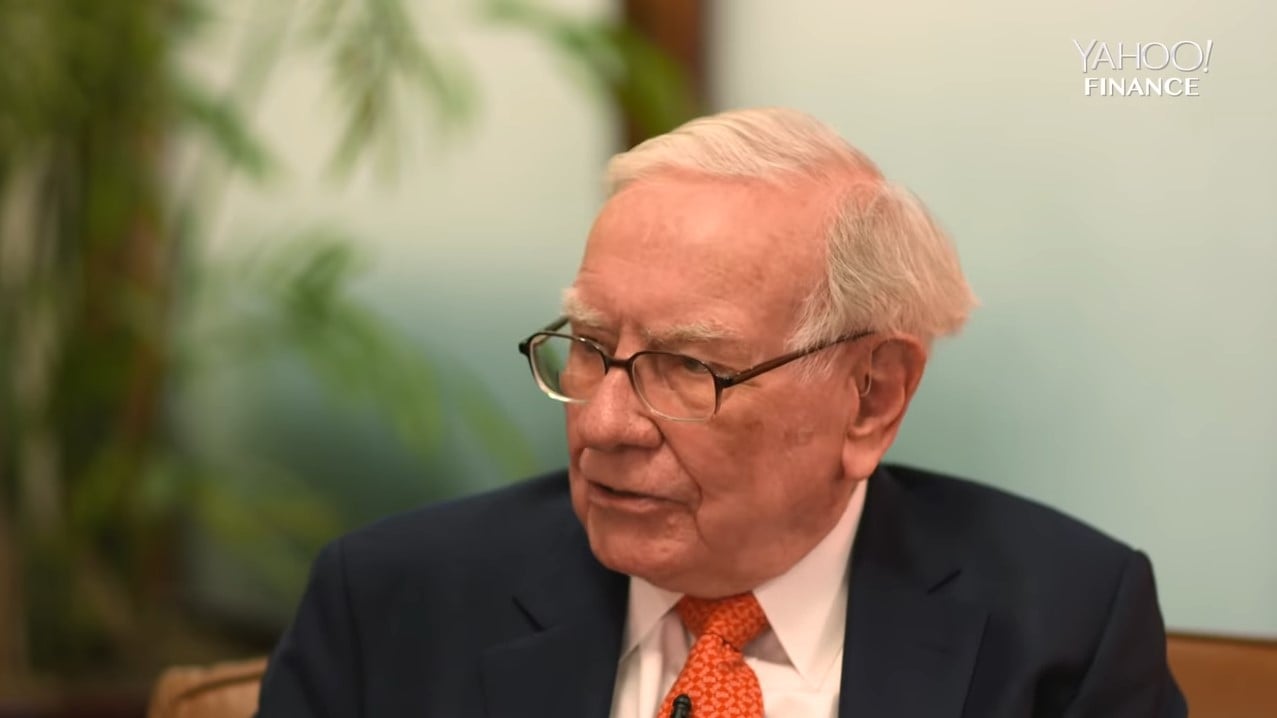

Berkshire Hathaway’s (NYSE: BRK.A) (NYSE:BRK.B) owner Warren Buffett is the most popular investor who built his $89.9 billion net worth by investing in value companies. He was among the few who profited from the 2008 crisis. In the current Covid-19 crisis, he is holding a lot of cash as most companies are not prepared for a pandemic-like crisis. Many companies have frozen their global operations and paused stock buybacks and capital spending to save money for the pandemic-driven recession.

Q1 2020 hedge fund letters, conferences and more

How Warren Buffett Deals With COVID-19 Crisis?

One sector which has emerged as a clear winner in the pandemic is technology. As people stay at home, they are spending more time online doing activities like shopping, working, video streaming, and gaming. Warren Buffett is not quite into tech stocks but he has invested in tech companies related to finance and consumer goods.

Buffett selects his stocks using the value investing approach in which he looks at a company’s financials like revenue, earnings, cash flow, and debt. He also looks at a company’s business model, brand value, its target market, and competition. Combining Buffett's expertise and tech sector’s growth momentum, here are three tech stocks, the Oracle of Omaha has exposure to.

Warren Buffett-Owned Tech Stocks

It comes as no surprise that a value investor like Warren Buffett has holdings in trillion tech dollar companies Apple and Amazon.

Apple - A Company With Strong Fundamentals

Apple (AAPL) has proved to be Buffett’s most successful investments of all time. Berkshire Hathaway holds a 5.7% stake in Apple which is currently valued at ~$71 million, the highest valued stock in Buffett’s portfolio. According to Visual Capitalist, Apple was the world’s third most valuable brand of 2020 with a brand value of $140 billion.

Apple is known for its premium products like iPhones, MacBook, and iPad. However, sales of these products have been slowing. Hence, the company has been increasingly focusing on their services segment which generates recurring cash flows. It earns 18% of its revenue from services such as Apple Music, Apple Pay, and Apple TV Plus. In fiscal 2019, Apple’s revenue fell 2% YoY (year-over-year) as 16% growth in service revenue was partially offset by 5% decline in product revenue.

Apple Stands Strong In COVID-19 Pandemic

Entering into the year of pandemic, Apple is seeing a significant decline in product sales as Apple stores remain closed during the lockdown. However, some of this decline will be offset by an uptick in service subscriptions. By the time the current macro situation improves in the second half, Apple would be ready with its next-generation 5G iPhone. As Apple enjoys brand loyalty, the new iPhone could boost its product sales, thereby, mitigating the declines in the first half of the year.

At a time when other companies have paused shareholder returns, Wall Street analysts expect Apple to use its $100 billion net cash to increase dividends and stock buyback, according to MarketWatch.

Apple has strong financials and fundamentals and the stock market sell-off in March opened a buy opportunity for investors. Although Apple stock has rallied 26% from its March low, it is still trading 14% below its February high of $327.85. The last time Apple’s stock fell was in December 2018 when its iPhone sales declined for the first time because of the US-China trade tensions. The stock recovered next year, growing 90% in 2019. Although the current pandemic situation is not the same, Apple has the resources to survive the crisis and grow its revenue when things normalize.

Amazon

Similar toApple, Amazon (AMZN) is yet another $1 trillion company which has become the world’s most valuable brand of 2020 ($220 billion), according to Visual Capitalist. Amazon’s CEO Jeff Bezos overtook Buffett to become the world’s richest man for the third row in a year. However, the stock is not an investor’s nirvana.

Amazon stock rose 17% in 2019, underperforming the S&P 500 Index which rose 30%. Moreover, the stock does not pay dividend as it reinvests its business. Hence, Buffett only has 0.1% stake in the company..

However, Amazon’s earnings are growing double-digit; revenue rose 20.5% to $280.5 billion and EPS (earnings per share) rose 14% to $23.01 in 2019. It has net cash of $31.6 billion. The company is venturing into growth markets like advertising services, shipping fleet, and business-to-business e-commerce where economies of scale will fetch good returns.

The pandemic has made Amazon a hot stock as more people are shopping online. The stock has grown 41% from its March sell-off reaching its all-time high of $2,461 in April at the height of the pandemic. It would not be wise to buy the stock at its all-time high, but it is a buy on dip.

Stone Co

Apple and Amazon fall in line with Buffett’s investment style of taking a long position in big companies. But the 89-year old investor shocked everyone in 2018 when he purchased over 14 million shares of Brazil-based fintech StoneCo (STNE) in its IPO. This purchase spiked the stock price by 30% in just two days of trading and attracted the interest of other investors like Jack Ma (Alibaba’s founder) and 3G Capital.

André Street and Eduardo Pontes founded Stone Co in 2012 offering merchants a cloud-based payment platform for e-commerce, across in-store, online, and mobile channels. After seven years, the company has grown to $25 million in revenue commanding 8% share in Brazil’s online payments market. It has become Brazil’s fourth largest payment-processing company after Cielo, Rede, and Getnet.

Stone earns money by charging fees for transaction payment processing, prepayment financing, subscription, and equipment rentals. An increase in transaction volumes and active clients boost revenue. In 2019, the firm increased its active customers by 84%, payment volume by 55%, and revenue by 63%. Unlike other growth stocks which are posting losses and burning cash, Stone is improving profits. The firm increased its adjusted net margin to 33.3% in 2019 (from 21.7% last year) by growing revenue faster than operating expenses. It also has net cash of $24 million.

With such strong financials, Stone stock rose 121% in 2019 and made an all-time high of $46.69 in February 2020 before the March sell-off. The pandemic has created panic among investors about emerging market economies like Brazil. Poor economic conditions and a decline in transactions could wipe out all the profitability. Moreover, the company is exposed to foreign currency fluctuations. These risks became more prevalent in the light of the pandemic crisis sending Stone stock down 45% in March

Stone stock is trading at its IPO level of $21 to $23, the price at which Buffett bought Stone stocks. Stone has a large untapped market in Brazil and South America where payment processing services have just begun. This is a good buy opportunity for a value stock like Stone which has a potential to grow as much as $40 when the situation normalizes.

Buying Tech The Buffett Way

Apple, Amazon, and Stone are financially sound companies with good growth potential. While the uncertainty has hit stocks of Apple and Stone, shares of Amazon have skyrocketed. This is the right time for long-term investors to buy Apple and Stone. Investors should keep an eye on Amazon and buy at a dip.

*Not investment advice