Not many years ago, few institutional investors would think of not including Apple in their portfolio, but a lot has changed. In fact, Microsoft has come back into favor again, while Apple has fallen out of favor, based on the latest list of the most crowded stocks from UBS.

Apple and Microsoft switched places

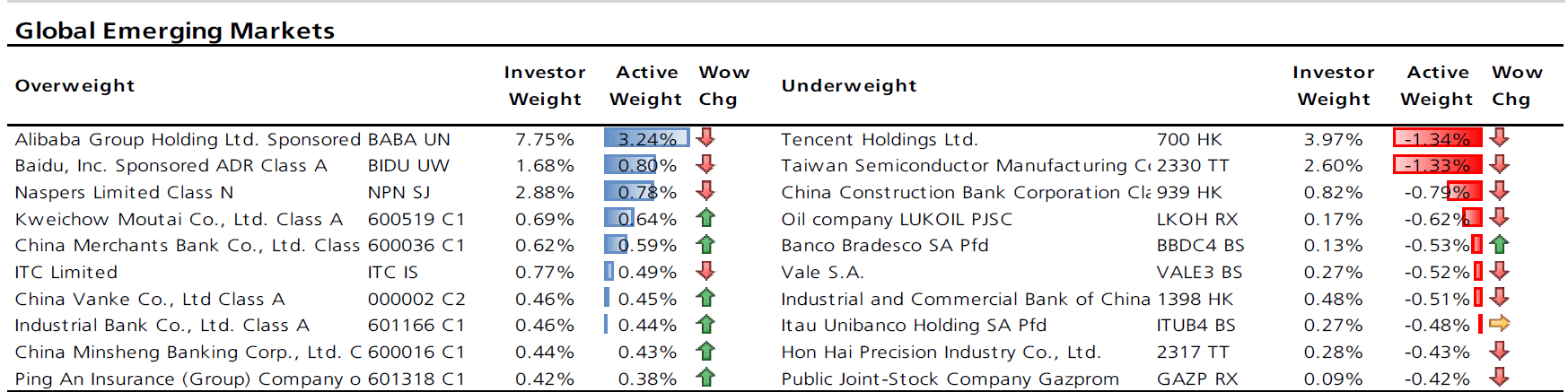

UBS calculates the most overweight and underweight positions based on institutional ownership data from FactSet by adding “up all the holdings in dollar value across all the active managers” and then calculating the weights of stocks in the active trading portfolio. The firm then compares their weights with the relevant equity index benchmark to estimate the active weight of each stock.

Q1 hedge fund letters, conference, scoops etc

According to the firm, Apple is now the biggest underweight among active fund managers around the globe. Microsoft is among the most overweight stocks, although it didn't top the list. Visa captured that honor, followed by Alibaba and not one, but two of Alphabet's share classes.

Interestingly, you may notice that ExxonMobil also made the list of the top underweights. Several years ago, Apple and ExxonMobil were battling for the largest market capitalization until the iPhone maker finally unseated the energy giant.

Another surprising underweight position

This development between Apple and Microsoft is interesting given the development of the acronym FAAMG over the years, which includes both Apple and Microsoft in addition to Facebook, Amazon and Alphabet. In fact, Amazon made the list of the biggest underweights among U.S. large-cap stocks, falling behind Apple and ExxonMobil. Other major underweights among U.S. large-caps include Berkshire Hathaway, AT&T, Intel, Walt Disney and Coca-Cola.

As you can see, the list of the biggest overweights among U.S. large-caps is almost completely different from the global list of the biggest overweights. Visa still tops the list, but Microsoft isn't on it. Adobe, Delta Air lines and PayPal did make the list, however.

Alibaba vs. Tencent

Looking at emerging markets, the biggest overweight globally is Alibaba, while the biggest underweight is Tencent. Both Chinese companies are part of the well-known acronym BAT, which is Baidu, Alibaba and Tencent. Baidu was also one of the biggest overweights globally.

Other top underweights among global emerging markets include chip maker TSMC and Hon Hai Precision, which makes sense given its strong connection with underweight Apple.

This article first appeared on ValueWalk Premium