“Diversification is the only free lunch in investing”, said economist David Markowitz in 1952. This sentiment would go on to form the foundation of Modern Portfolio Theory (MPT) and win Markowitz a Nobel Prize.

The “free lunch” in question is the reduced risk that comes with increased diversification. The maths behind it is pretty straightforward.

Q4 2019 hedge fund letters, conferences and more

Say you have five different assets to choose from and you want to add three of them to your portfolio. All of them have a risk-adjusted expected annual return of 5%.

No matter which three you choose, you still have a total expected annual return of 5%. And yet, there’s still a right and a wrong way to choose.

According to Markowitz’s theory, the correct choice is to pick the three assets whose prices have historically shown the least correlation with each other. Now your total expected annual returns are still 5%, but even if disaster strikes one of those assets, it’s less likely to also strike the other two.

By deliberately choosing three uncorrelated assets out of the hypothetical five, you’ve functionally reduced your risk without reducing your total expected returns. That reduced risk is the “free lunch” Markowitz was talking about.

The catch, of course, is that you’re also missing out on some potential upside. If one of those three highly-correlated assets performs exceptionally well, it’s likely that the other two will too.

That said, investment philosophers have argued that numbers still favour diversification because it protects against the unexpected. And in the world of investments, where profit is by definition the expected outcome, the majority of unexpected occurrences are bad news.

Ergo, free lunch is tasty.

What the free lunch looks like in the real world

Of course, it’s not that simple in the real world, where everything has different expected returns and there are an infinite number of different risks.

Or is it?

Mathematically speaking, there are two ways of diversifying a portfolio and eating Markowitz’s free lunch.

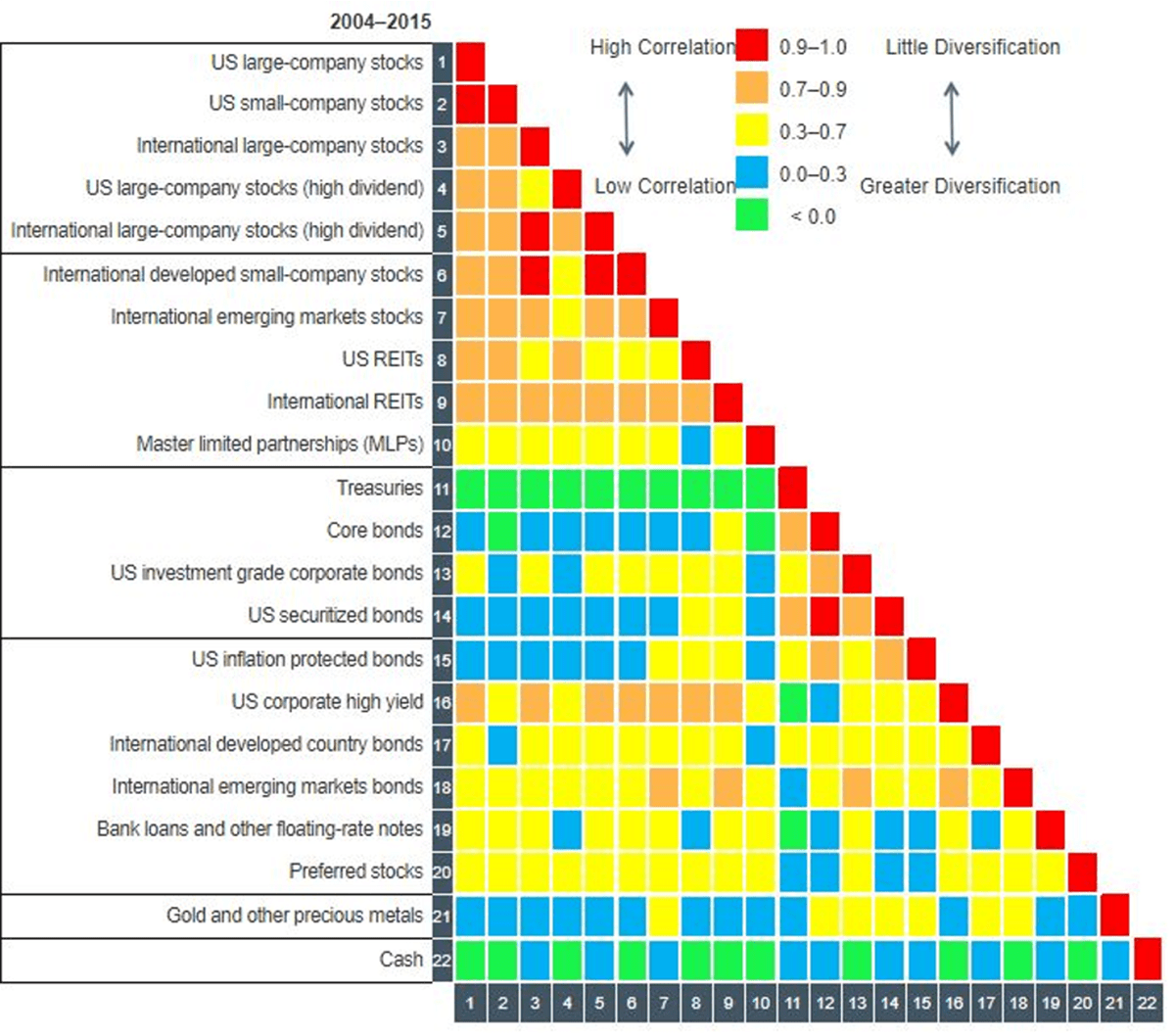

The first is simply to have a more diversified portfolio. This is easier said than done though. As you can see from the (outdated) chart below, taken from the Charles Schwab Intelligent Portfolio Asset Allocation Whitepaper, most asset classes tend to have some kind of correlation.

It’s tough to assemble a portfolio of uncorrelated or negatively correlated assets, especially if the portfolio is intended to lean towards traditionally higher-risk and higher-performing asset classes like stocks.

Geographical diversification and stock indexes will only go so far. Alternative assets such as real estate and commodities are also closely tied to other markets. In fact, per the above chart, both US and international real estate investment trusts (REITs) were strongly correlated with stock market performance.

The other way is to simply have more different assets in a portfolio. More different assets and asset classes means more diversification. But once again, this only goes so far.

Remember, the objective according to MPT is to assemble a portfolio with more lowly and negatively-correlated asset classes. It’s arguably more diverse to have two negatively correlated assets than a hundred tightly correlated ones.

In the face of these challenges, what’s a Markowitz fan (especially one who’s already eaten their share of free lunch from cash and bonds) to do?

Getting creative

One statistically sound option is to consider how closely different industries correlate with each other, or even how individual companies may perform in different situations.

Walmart (WMT), for example, boomed in the years of the global financial crisis. The rise of online share trading platforms has made it easier to get hands-on with investing and some people prefer that approach.

And gold, despite its functional uselessness (“it doesn't do anything but sit there and look at you”, as Warren Buffet said) tends to be largely uncorrelated with other markets.

Perhaps this lack of correlation is there precisely because it doesn’t really do anything? Maybe there’s something to be said for investing in pointless things.

Art, classic cars and antiques fall into this class of investments and they’re also wonderfully uncorrelated with mainstream investments. Unfortunately, the minimum investment needed for these, to say nothing of the maintenance costs they incur and the expertise needed for them, means they aren’t an option for the vast majority of people.

A much more attainable option, which most people never really consider, is cryptocurrency.

While Bitcoin is most commonly remembered for its eye-watering gains (and bone-crunching crash), the whole point of MPT is that it doesn’t actually have to keep going up to be a statistically sane addition to a balanced portfolio.

Bitcoin’s absurd volatility means it tends to be consistently uncorrelated with every other asset class, which may counter-intuitively make it a “safe” investment per MPT. You might be surprised to learn that some pension funds and university endowments, which typically diversify in line with Markowitz’s MPT, have added cryptocurrency to their portfolios.

And while its fans might like to talk up cryptocurrency as some kind of technological wizardry, the fact is buying cryptocurrency is actually very uncomplicated. Much like opening an online share trading account, buying cryptocurrency is as easy as creating an account at an online cryptocurrency exchange.

There are never any guarantees in investing, but there are some free lunches if you look for them.

However, on a cautionary note, nothing in this article should be taken as financial advice. This piece is simply an exploration of the maths behind diversification and some examples of how these principles might be applied with different assets and asset classes. It’s not intended as an endorsement of any assets or asset classes mentioned here.

Plus, Markowitz’s principles are called Modern Portfolio Theory, not Modern Portfolio Fact, and free lunch may not be suitable for everyone’s financial situation.