Whitney Tilson’s email to investors discussing the IBM value trap; Are Analyst Trade Ideas Valuable?; Bitcoin Rally Fuels Market in Crypto Derivatives; My theory on where Jeffrey Epstein and Ghislaine Maxwell got their BIG money.

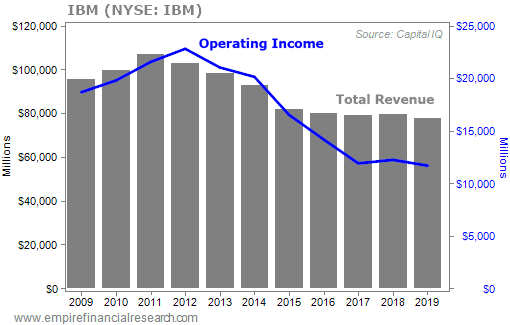

1) IBM (IBM) reported yet another dismal quarter after the close yesterday, in which revenue fell 4.2% and operating income (excluding “other income and expense” and interest expense) tumbled 26.6%.

Q2 hedge fund letters, conference, scoops etc

Here's a chart of IBM's revenue and operating income since the beginning of this long economic expansion and bull market that started more than a decade ago...

What a melting ice cube this is – a classic value trap. I've warned my readers away from this dog over and over again since January 2001 when I listed it among my "stocks to avoid." I wrote then: "IBM's top- and bottom-line growth is nonexistent, net debt is rising, and cash flows are falling." How little things have changed...

When Warren Buffett bought the stock, I wrote to him twice begging him to sell it – and, as a longtime Berkshire Hathaway (BRK.A) shareholder at the time, I was so relieved when he did.

I'm not sure IBM is a great short today, but I wouldn't dream of owning it.

2) I've long held most Wall Street analysts in low esteem. In fact, I usually put "analysts" in quotes because I think most of them don't really do much analysis. Rather, they pump stocks – or at least don't warn investors about bad ones – to curry favor with companies so that they'll maintain access to management and/or generate banking business for their firms.

So I was surprised to see this study that reveals outperformance by analysts' trading ideas (not to be confused with their long-term Sell, Hold, Buy, and Strong Buy ratings). I also find it interesting that "more established" analysts tend to make better trading calls – what one would expect if there was some skill involved. Lastly, I'm not a bit surprised that big clients apparently get the ideas before everyone else...

Here's the study, Are Analyst Trade Ideas Valuable?, and here's the summary...

Using a novel database, we show that the stock-price impact of analyst trade ideas is at least as large as the impact of stock recommendation, target price, and earnings forecast changes, and that investors following trade ideas can earn significant abnormal returns. Trade ideas triggered by forthcoming firm catalyst events are more informative than ideas exploiting temporary mispricing. Institutional investors trade in the direction of trade ideas and commission-paying institutional clients do so earlier than non-clients. Analysts generating trade ideas are more established and are more likely to produce ideas for stocks with high dollar trading commissions in their coverage universe.

My take: this doesn't change my overall view that investors need to do their own work and should be highly skeptical of analysts' ratings and recommendations. But if you see a veteran analyst with a good track record make a big call – perhaps that a company might buy back a lot of stock, spin off a division, or put itself up for sale – do some digging to determine for yourself if the analyst might be right...

3) The only idea worse than speculating in bitcoin is double speculating in bitcoin derivatives. This truly is what Buffett rightly calls "rat poison squared"! I guarantee that this will end very badly... Bitcoin Rally Fuels Market in Crypto Derivatives. Excerpt:

Wall Street has dreamed up an array of derivatives tied to stocks, commodities and mortgages. Now such contracts are being developed for bitcoin.

In recent months, some cryptocurrency firms have begun touting structured products linked to the price of bitcoin, with complex formulas determining how much they pay out.

It is still a small market, and the firms say their products aren't aimed at mom-and-pop investors. But the trend is raising red flags among some market veterans, especially as bitcoin's rebound above $10,000 has rekindled investor interest in the digital currency.

Craig McCann, a former Securities and Exchange Commission economist, warns that it is a bad idea to take bitcoin – a highly volatile, speculative asset traded on unregulated exchanges – and use it as a building block for complex instruments.

"There are all kinds of problems associated with any structured product tied to bitcoin," said Mr. McCann, who now leads Securities Litigation & Consulting Group, a firm that provides expert witnesses for companies involved in securities lawsuits. "It doesn't belong in anybody's portfolio."

4) I'm fascinated by the Jeffrey Epstein story. He lives two miles from me and was supposedly in my industry (though I doubt he ever really managed money), but I never encountered him – thankfully, as he is pure evil.

I don't support the death penalty, for reasons New York Times columnist Nick Kristof articulates well here: When We Kill: Everything you think you know about the death penalty is wrong. But if I were to make an exception, Epstein would be close to the top of the list.

Close behind would be his girlfriend, socialite Ghislaine Maxwell. She was his pimp, recruiting underage girls – the younger, the better by all accounts – for Epstein to molest/rape, often with Maxwell participating. I've heard from a very good source that she wasn't even subtle about her pimping – it was right out in the open. (For more on her, see this New York Times article: The 'Lady of the House' Who Was Long Entangled With Jeffrey Epstein.)

I just finished reading the excellent book by James Patterson (yes, that James Patterson) about Epstein, published in 2016: Filthy Rich: A Powerful Billionaire, the Sex Scandal That Undid Him, and All the Justice That Money Can Buy: The Shocking True Story of Jeffrey Epstein.

An interesting question is where Epstein got his money. Here's my theory...

I think he might have made about $50 million with various schemes like helping people set up questionable tax-avoidance schemes. But that doesn't explain the big money necessary for the planes, island, mansions, etc.

Here's my theory about where he got it – from Maxwell!

Recall that she was the favorite youngest child of British publishing magnate Robert Maxwell. He even named his yacht, the Lady Ghislaine, after her.

It was on this very boat where Maxwell was last seen before he was found dead in the Atlantic Ocean in 1991. To this day, it's not clear what happened, but I think it was likely suicide.

His businesses were crashing down around him and it emerged soon after his death that he'd looted about $800 million from his employees' pension funds to try to stave off bankruptcy. Investigators were able to account for most of the money, but a few hundred million dollars was never found.

My theory is that Maxwell, not wanting to leave his beloved Ghislaine destitute, put this money into a Swiss bank account and gave her the number. (Alternatively or in addition, he might have left her other hidden assets from his enormously complex global empire.)

After her father died, Ghislaine relocated to the U.S. and laid low for a while, as any ostentatious spending would attract attention. Also, she needed to figure out a way to launder the dirty money into the U.S.

While there, she fell in love with Epstein. It turns out they were both into sex with underaged girls... And who better to figure out a way to launder the money – through his offshore business...

They split the money and started living the high life...

Best regards,

Whitney